Small discretionary expenses reveal spending patterns and directly impact wealth-building potential in ways that fixed expenses cannot

When financial advisors talk about budgeting, they immediately point to the big numbers: your mortgage, car payment, student loans. "Attack the big expenses first," they say. "Focus on the major line items."

It's logical advice. After all, your $2,000 mortgage payment dwarfs your $4 coffee purchase. But here's what conventional financial wisdom gets wrong: your discretionary spending—those seemingly small, everyday choices—might be more important for your financial future than your major fixed expenses.

This isn't about coffee-shaming or suggesting you live on rice and beans. It's about understanding why discretionary spending serves as the ultimate indicator of financial health, wealth-building potential, and long-term financial success.

The Behavior Mirror: What Your Small Spending Really Shows

Your mortgage payment tells us one thing: you qualified for a loan several years ago. Your discretionary spending tells us everything else about your financial behavior, impulse control, and money mindset.

Unlike fixed expenses that happen automatically, every discretionary purchase is a choice. That $4 coffee? You chose it over saving $4. The $15 lunch instead of the $8 option? You chose convenience over thrift. The subscription you forgot to cancel? You chose neglect over attention.

"Fixed expenses show your past decisions. Discretionary spending reveals your present financial character."

These small choices create patterns that compound over time, not just financially but behaviorally. Research in behavioral economics shows that people who make mindful choices with small amounts develop better decision-making patterns for larger financial decisions.

Consider two people with identical incomes and fixed expenses:

- Person A mindfully manages discretionary spending, rarely making impulse purchases

- Person B spends freely on daily conveniences and spontaneous wants

Over time, Person A doesn't just accumulate more wealth—they develop stronger financial discipline that affects every aspect of their financial life, from career negotiations to investment decisions.

Discretionary spending patterns reveal deeper financial behaviors and decision-making abilities

The Wealth Transfer Effect: Where Your Future Fortune Goes

Here's a startling truth: the money you spend on discretionary items isn't just gone—it's a direct transfer from your future wealthy self to your present spending self.

Every dollar spent on non-essentials represents a dollar that could have been invested in your financial future. But it's not just about the dollar—it's about the opportunity cost of that dollar growing over time.

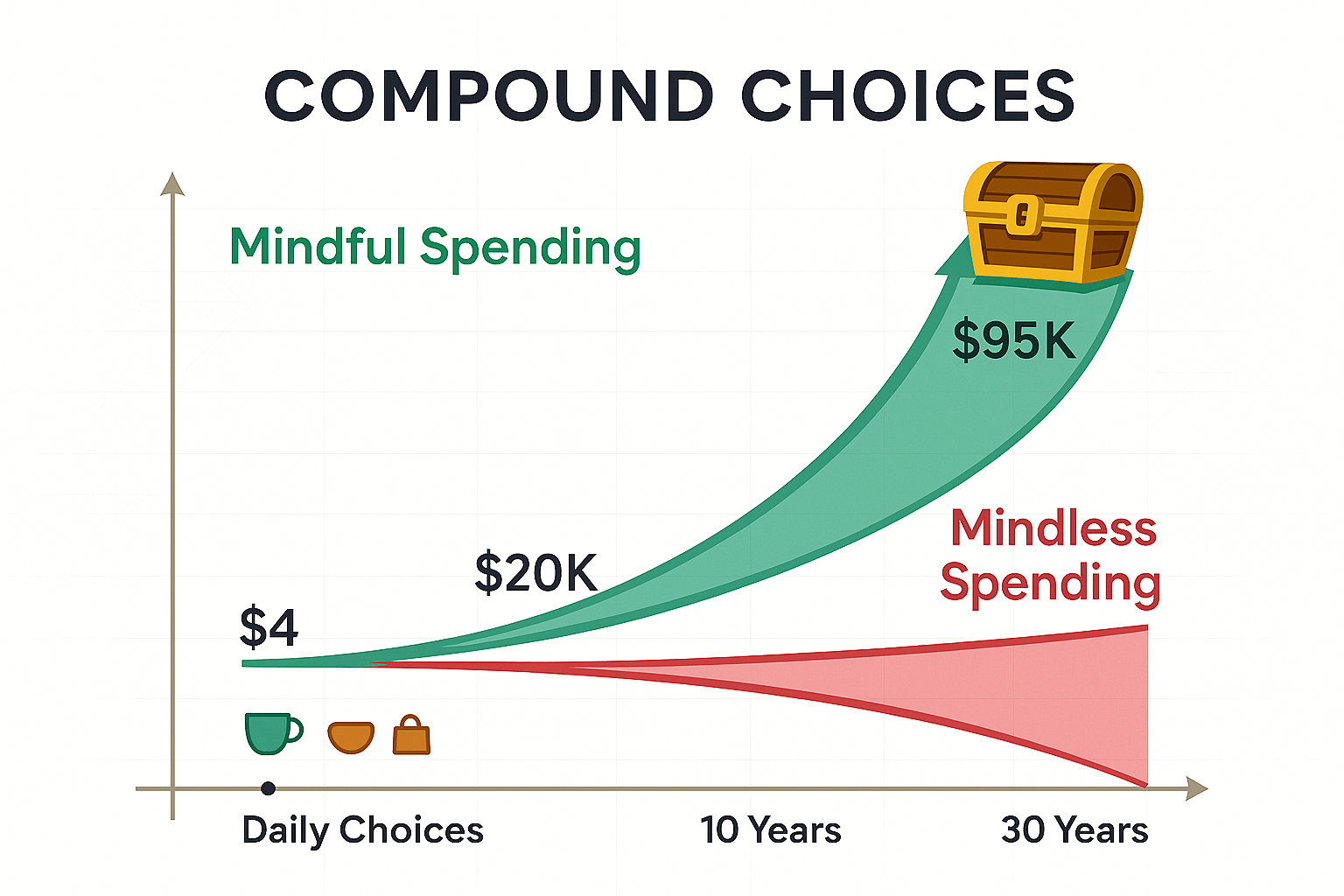

Let's examine the real cost of common discretionary spending:

| Daily Expense | Annual Cost | 10-Year Investment Value* | 30-Year Investment Value* |

|---|---|---|---|

| $4 coffee (daily) | $1,460 | $20,100 | $95,400 |

| $12 lunch upgrade (5x/week) | $3,120 | $42,900 | $204,000 |

| $25 impulse purchases (2x/week) | $2,600 | $35,800 | $170,000 |

| $50 entertainment (weekly) | $2,600 | $35,800 | $170,000 |

*Assuming 7% annual investment return

These numbers reveal the hidden wealth transfer happening through discretionary spending. That daily coffee isn't just $4—it's potentially $95,400 of retirement wealth. The lunch upgrade isn't just $12—it's potentially $204,000 over three decades.

But here's the crucial insight: You can't apply this same thinking to fixed expenses. You need housing, transportation, and insurance. These aren't choices—they're necessities. Your discretionary spending, however, represents pure choice and pure opportunity cost.

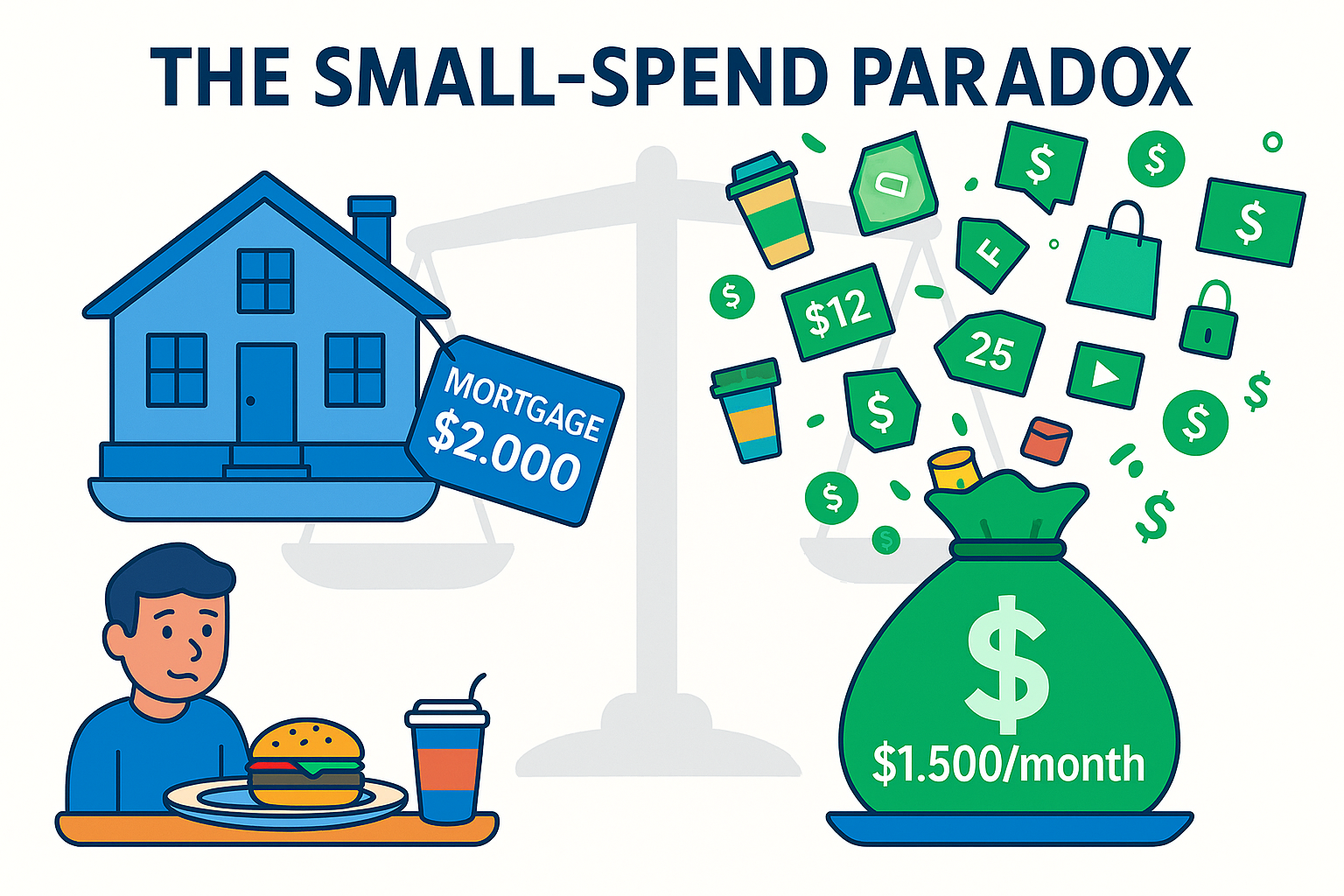

The Death by a Thousand Cuts Phenomenon

Perhaps the most dangerous aspect of discretionary spending is how it accumulates invisibly. A $2,000 mortgage payment is obvious and tracked. But discretionary spending happens in small amounts that seem insignificant individually while creating massive impact collectively.

Research from the Federal Reserve shows that the average American household spends $18,000 annually on discretionary items. That's $1,500 per month—nearly as much as many people's mortgage payments—flowing out through small, seemingly inconsequential purchases.

This creates what we call the "Death by a Thousand Cuts" phenomenon:

- Each individual purchase feels small and manageable

- The cumulative impact remains hidden until it's too late

- The wealth-building opportunity is lost gradually and imperceptibly

- The behavioral patterns become deeply ingrained over time

The Visible Giant

$2,000/month mortgage payment: Planned, budgeted, conscious, and necessary for shelter

The Invisible Giant

$1,500/month discretionary spending: Unplanned, unbudgeted, unconscious, and purely optional

The invisible giant is often larger than the visible one, but because it comes in $5, $15, and $25 increments, it never feels significant enough to address.

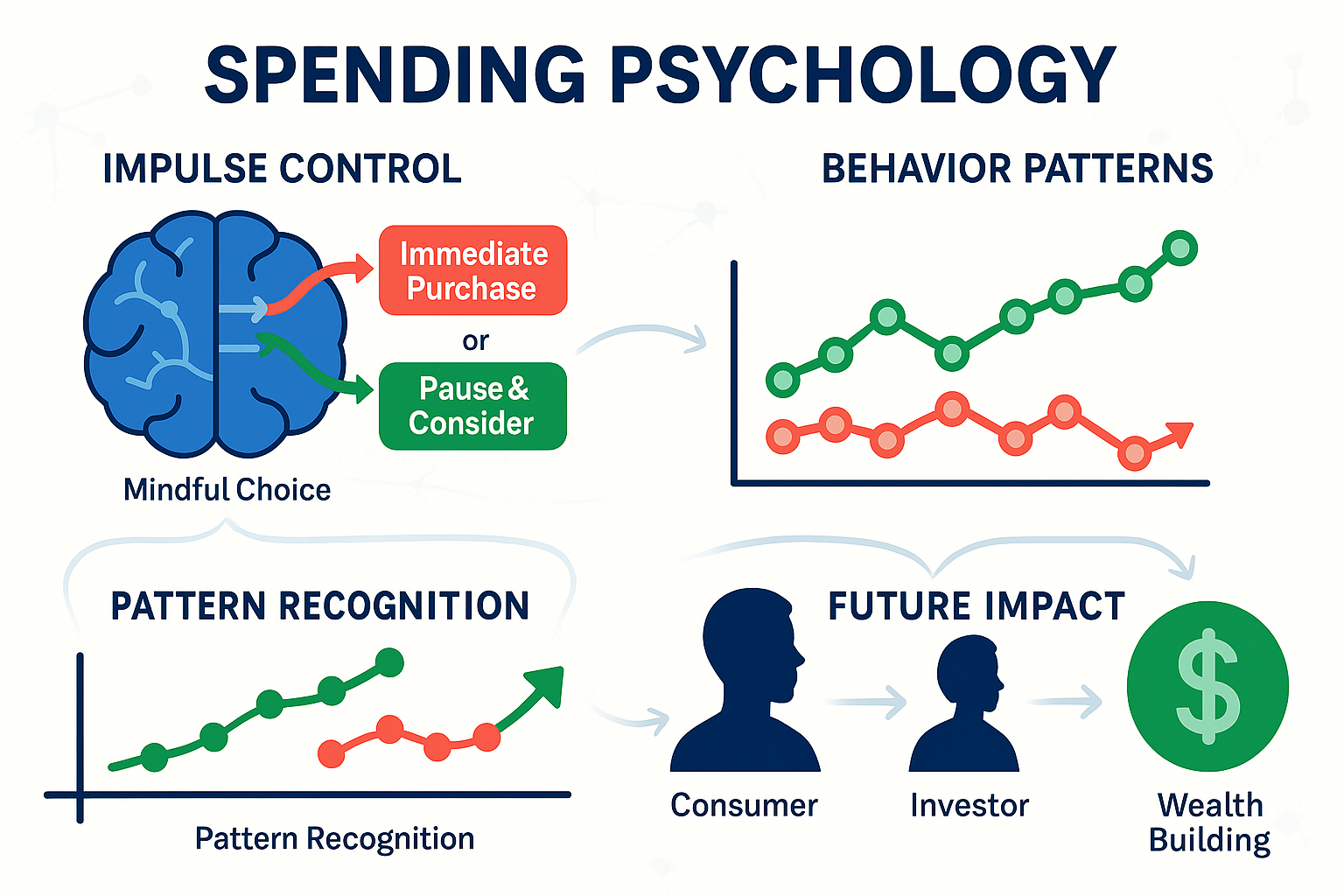

The Impulse Control Laboratory

Your daily discretionary spending decisions serve as a laboratory for impulse control—one of the most important skills for long-term financial success.

Every time you see something you want but don't need, you face a choice:

- Act on impulse (instant gratification)

- Pause and consider (delayed gratification)

These micro-decisions, repeated hundreds of times per month, either strengthen or weaken your impulse control muscle. Unlike major financial decisions that happen rarely, discretionary spending provides daily training for the financial discipline that determines long-term wealth accumulation.

Studies in behavioral psychology show that people who can delay gratification in small, daily situations are more likely to:

- Save consistently for retirement

- Avoid high-interest debt

- Make better investment decisions

- Negotiate better salaries and contracts

- Build emergency funds

Your $4 coffee decision isn't just about coffee—it's training for every financial decision you'll make in the future.

The Compound Effect of Small Choices

While a $2,000 mortgage payment remains relatively static over time, discretionary spending compounds in multiple ways:

1. Financial Compounding

Money not spent on discretionary items can be invested, creating compound returns over decades.

2. Behavioral Compounding

Each mindful spending decision makes the next one easier, creating a positive feedback loop of financial discipline.

3. Lifestyle Inflation Protection

Managing discretionary spending prevents lifestyle inflation that can devastate wealth accumulation as income increases.

4. Decision-Making Skill Development

Regular practice with small financial decisions improves judgment for larger financial choices.

Small discretionary spending decisions compound both financially and behaviorally over time

The Flexibility Factor: Your Financial Shock Absorber

Fixed expenses are just that—fixed. When financial emergencies arise, you can't easily reduce your mortgage payment or eliminate your insurance premium. But discretionary spending provides crucial financial flexibility.

During economic uncertainty, job loss, or unexpected expenses, your discretionary spending becomes your financial shock absorber. The person who has developed habits of mindful discretionary spending has:

- Immediate Cost-Cutting Ability: Can reduce expenses quickly without major lifestyle disruption

- Emergency Fund Preservation: Can maintain essential expenses longer during income interruptions

- Stress Reduction: Experiences less financial anxiety because they have controllable expense categories

- Opportunity Seizure: Can redirect funds quickly when investment or career opportunities arise

This flexibility is impossible with fixed expenses but readily available with discretionary spending—making it a crucial component of financial resilience.

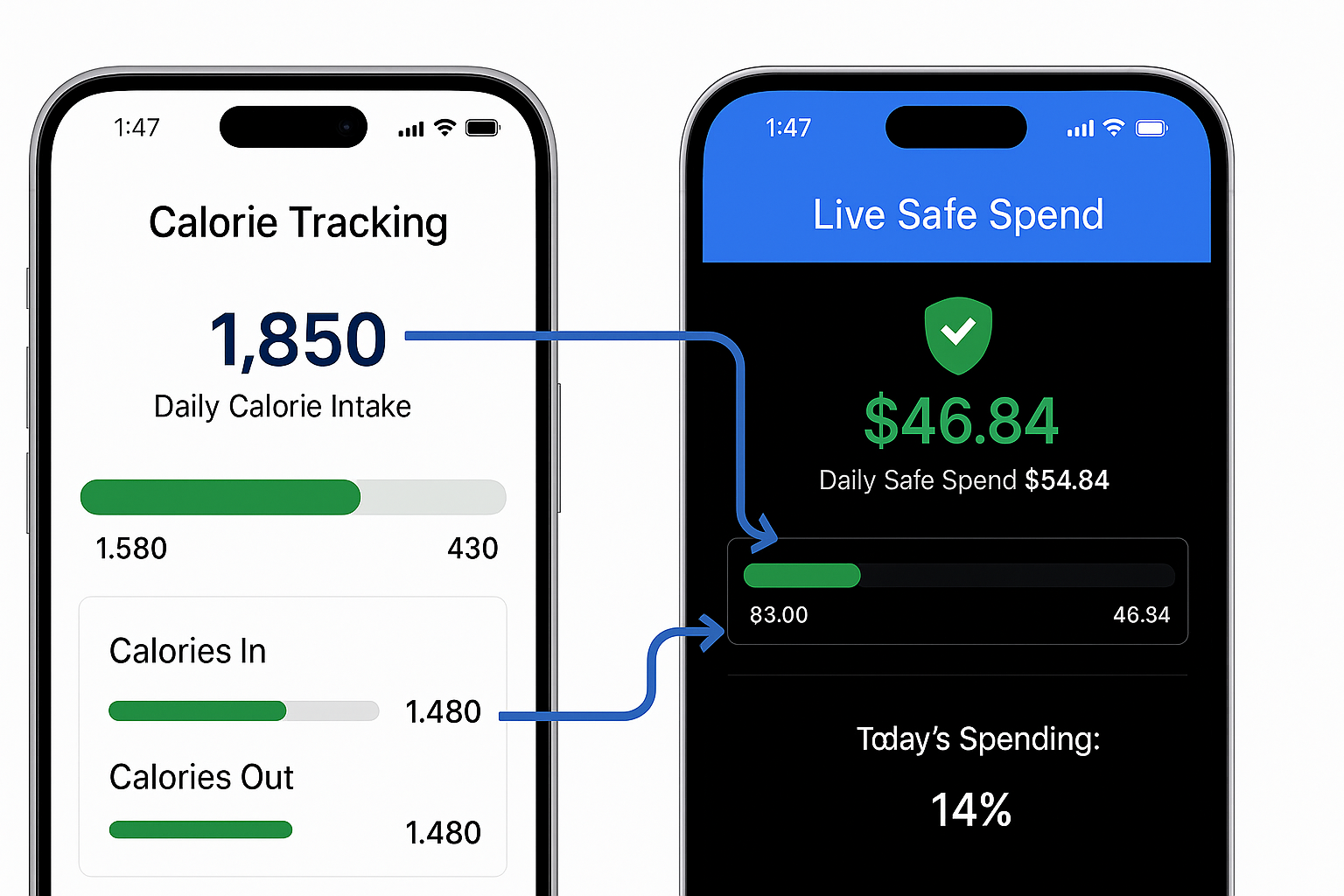

What Real People Discover: The DASPR Effect

When DASPR users start tracking their discretionary spending, they consistently report similar discoveries:

"I thought I was pretty good with money because I had a mortgage and was paying my bills. Then I started tracking my discretionary spending and realized I was spending $400 a month on things I couldn't even remember by the end of the week."

— Sarah, early DASPR beta tester"My mortgage is $1,800 a month and I thought that was my biggest expense. Turns out my discretionary spending was $1,200 a month—and that was money I had complete control over but wasn't exercising that control."

— Mike, DASPR early adopter"The revelation wasn't the amount I was spending—it was realizing that every dollar I spent mindlessly was a dollar I wasn't investing in my future. My discretionary spending was literally stealing from my retirement."

— Jessica, DASPR beta userThese discoveries highlight a crucial truth: discretionary spending often represents the largest controllable expense in people's budgets, yet it receives the least attention and oversight.

The Small Spend Opportunity

Unlike fixed expenses, discretionary spending offers immediate opportunities for optimization without major life changes:

Quick Wins Available Today

- Pause before impulse purchases

- Choose generic brands for non-essential items

- Eliminate forgotten subscriptions

- Reduce frequency of convenience purchases

- Find free alternatives for entertainment

No Major Lifestyle Disruption Required

- You don't need to move to a smaller home

- You don't need to change jobs or commute

- You don't need to eliminate entire categories of spending

- You don't need to make dramatic lifestyle changes

Immediate Financial Impact

- Reduced spending creates immediate cash flow improvement

- Eliminated waste frees up money for wealth building

- Mindful choices create positive momentum

- Small changes compound quickly over time

The Psychology of Financial Control

Perhaps most importantly, managing discretionary spending provides a sense of financial control that's impossible to achieve with fixed expenses.

When you successfully manage your discretionary spending:

- You feel empowered rather than constrained by your budget

- You develop confidence in your financial decision-making abilities

- You create positive momentum that extends to other financial areas

- You build financial self-efficacy that supports long-term wealth building

This psychological benefit is crucial for long-term financial success. People who feel in control of their finances are more likely to:

- Save consistently

- Invest regularly

- Make strategic financial decisions

- Avoid financial stress and anxiety

- Pursue wealth-building opportunities

Beyond the Numbers: The Identity Shift

Managing discretionary spending effectively creates an identity shift from "consumer" to "investor." Each mindful spending decision reinforces the identity of someone who prioritizes future wealth over present consumption.

This identity shift affects every aspect of your financial life:

- Career decisions: Investors negotiate better salaries and seek career advancement

- Investment choices: Investors think long-term and avoid speculative decisions

- Spending patterns: Investors consider opportunity cost before purchases

- Financial planning: Investors plan for the future rather than just managing the present

Your discretionary spending decisions are daily votes for the type of person you want to become financially.

The Integration Strategy: Making It Work

The goal isn't to eliminate all discretionary spending—it's to make it intentional and aligned with your values. Here's how to approach discretionary spending strategically:

1. Track Everything First

You can't manage what you don't measure. Track every discretionary expense for at least 30 days to understand your patterns.

2. Identify Your Values

Determine which discretionary expenses align with your values and which are just habits or impulses.

3. Create Conscious Boundaries

Set specific amounts for discretionary categories and stick to them, just like you would with fixed expenses.

4. Apply the 24-Hour Rule

For non-essential purchases over a certain amount, wait 24 hours before buying to avoid impulse decisions.

5. Calculate Opportunity Cost

Before spending, quickly calculate what that money could become if invested instead.

Track & Measure

Record every discretionary expense

Identify Values

Align spending with priorities

Set Boundaries

Create conscious spending limits

Pause & Consider

Wait before impulse purchases

Calculate Cost

Consider long-term opportunity

Conclusion: The Small Spend Revolution

Your mortgage payment is what it is—a fixed obligation that provides necessary shelter. Your discretionary spending, however, represents pure financial choice and unlimited opportunity for wealth building.

While personal finance experts obsess over refinancing mortgages or finding cheaper insurance, the real wealth-building opportunity lies in the hundreds of small spending decisions you make every month.

These small decisions:

- Reveal your true financial character

- Directly transfer wealth from your future to your present

- Provide daily training for financial discipline

- Create flexibility during financial emergencies

- Compound both financially and behaviorally over time

The paradox is real: your $4 coffee decision carries more wealth-building potential than your $2,000 mortgage payment because it represents pure choice, compounding opportunity, and behavior development.

Ready to turn your small spending decisions into wealth-building opportunities? Download DASPR and discover how daily spending awareness can transform your financial future one decision at a time.

"Wealth isn't built through a few large decisions—it's built through thousands of small, conscious choices made consistently over time."

Share this article: