Both calorie tracking and financial tracking create awareness and provide a single daily number that guides mindful decisions

Have you ever wondered why calorie tracking apps like MyFitnessPal and Lose It! are so effective for millions of people? And what if the same principles that make them work could be applied to your finances?

At first glance, tracking food and tracking money might seem like entirely different activities. But when we look deeper at the behavioral psychology behind them, a fascinating pattern emerges: the same core principles drive success in both domains.

This isn't a coincidence. When we designed DASPR, we deliberately studied the most successful health and fitness apps to understand why they work so well. The parallels we discovered became foundational to our approach to financial wellness.

In this article, we'll explore the remarkable similarities between calorie tracking and financial tracking, and why these parallels matter for your financial health.

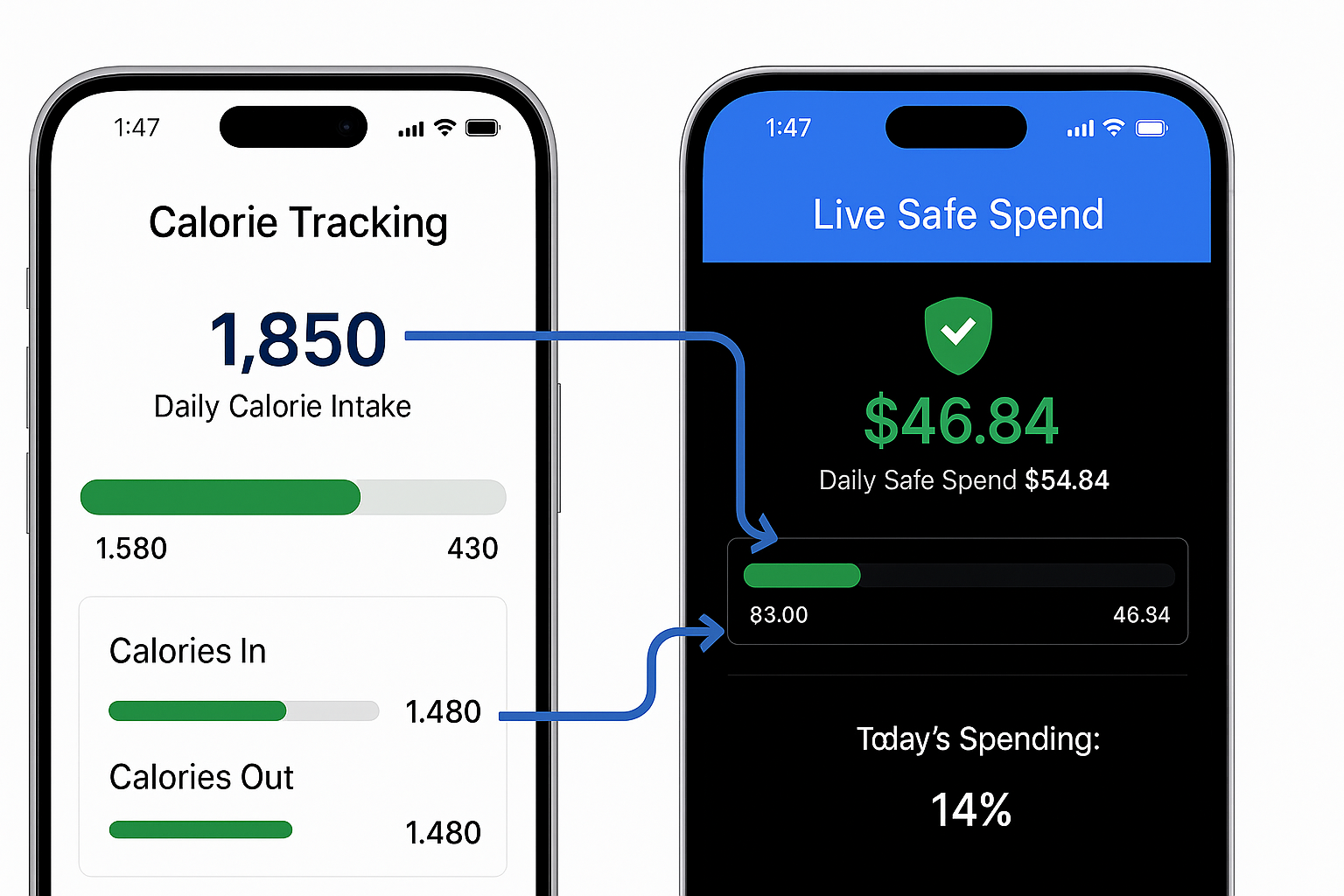

The Daily Number: Your North Star

The most successful calorie tracking apps don't overwhelm you with complex nutritional data. Instead, they give you one clear number: your daily calorie target. This single number becomes your North Star for making food decisions throughout the day.

Similarly, DASPR doesn't bombard you with complex financial metrics. It gives you one clear number: your Daily Safe Spend. This single figure serves as your North Star for making spending decisions throughout the day.

| Calorie Tracking | DASPR |

|---|---|

| Daily calorie target (e.g., 2,000 calories) | Daily Safe Spend (e.g., $65) |

| Calories remaining today | Safe Spend remaining today |

| Weekly average consumption | Weekly average spending |

| Nutrition "budget" for the day | Spending "budget" for the day |

This single-number approach works because it dramatically simplifies decision-making. Instead of juggling multiple variables, you can ask one simple question: "How does this choice affect my daily number?"

Research in cognitive psychology shows that this simplification reduces decision fatigue and increases the likelihood of making choices aligned with your goals.

The Awareness Effect: You Change What You Track

Perhaps the most powerful parallel between calorie tracking and financial tracking is what researchers call the "awareness effect" — the phenomenon where simply tracking a behavior often changes it, even without conscious effort.

Studies consistently show that people who track their food intake typically consume 15-20% fewer calories without explicit calorie restrictions. The mere act of recording creates awareness that subtly influences choices.

We see the identical pattern with financial tracking. DASPR users who consistently record their discretionary spending typically reduce it by 15-18%, even without setting specific spending limits.

"In both nutrition and finance, awareness isn't just the first step toward change—it's often the most powerful intervention on its own."

This awareness effect explains why both calorie tracking and financial tracking can feel almost magical in their impact. You're not following strict rules or depriving yourself—you're simply becoming conscious of choices that were previously automatic.

This awareness creates a subtle but significant "pause" before decisions, allowing your intentions to influence choices that might otherwise be driven by habit or impulse.

The same psychological mechanisms drive success in both nutrition and finance

Manual Recording: The Power of the Pause

A fascinating insight from behavior research is that manual recording creates more behavior change than automatic tracking. This seems counterintuitive in our automation-obsessed world, but the evidence is clear.

Studies comparing manual calorie tracking to automatic tracking (like with wearable devices) consistently show that the manual approach leads to more significant behavioral changes. The reason? The moment of recording creates a powerful pause for reflection.

The same principle applies to financial tracking. While many financial apps automatically import all your transactions, DASPR intentionally focuses on manual recording of discretionary spending for the same reason—that moment of recording creates the pause where behavior change happens.

Calorie Tracking Moment

"I'm about to eat this cookie. If I log it, I'll have 120 fewer calories for dinner. Is it worth it?"

DASPR Moment

"I'm about to buy this $15 item. If I record it, I'll have $15 less in my Daily Safe Spend. Is it worth it?"

This pause—lasting just seconds—turns automatic behaviors into conscious choices. It's not about restricting yourself; it's about making decisions with awareness rather than on autopilot.

Ballpark Accuracy: Good Enough Works Better

Successful calorie trackers don't obsess over perfect accuracy. They know that a ballpark estimate of a meal's calories is sufficient to create awareness and support better decisions.

Similarly, DASPR embraces the power of ballpark financial tracking. You don't need to record $4.35 for coffee—$4 or $5 is perfectly fine. The point isn't accounting precision; it's awareness of your spending choices.

This ballpark approach works better because:

- It reduces friction, making consistent tracking more likely

- It prevents perfectionist abandonment ("If I can't track perfectly, why bother?")

- It keeps focus on patterns rather than trivial details

In both domains, consistency trumps precision. A ballpark estimate recorded reliably creates far more positive change than perfect data captured sporadically.

The Buffer System: Flexibility Within Structure

The most sustainable calorie tracking apps don't expect perfect adherence every day. They include buffer systems like "weekly averages" or "flex calories" that provide flexibility within structure.

These buffers recognize a fundamental truth about human behavior: rigid systems eventually break, while flexible systems bend and endure.

DASPR applies this same insight with its Flex Buffer feature—a rolling accumulation of unspent daily amounts that provides flexibility for occasional larger expenses or special occasions.

| Calorie Tracking Buffers | DASPR Buffers |

|---|---|

| Weekly average target vs. daily target | Flex Buffer accumulation of unspent amounts |

| "Earned" calories from exercise | Accumulated buffer from under-spending |

| Special occasion allowances | Exception handling for unusual expenses |

This balanced approach avoids the all-or-nothing mindset that derails so many budgeting attempts. Just as the occasional indulgence doesn't ruin a healthy diet, the occasional splurge doesn't derail financial health when it's planned within a flexible system.

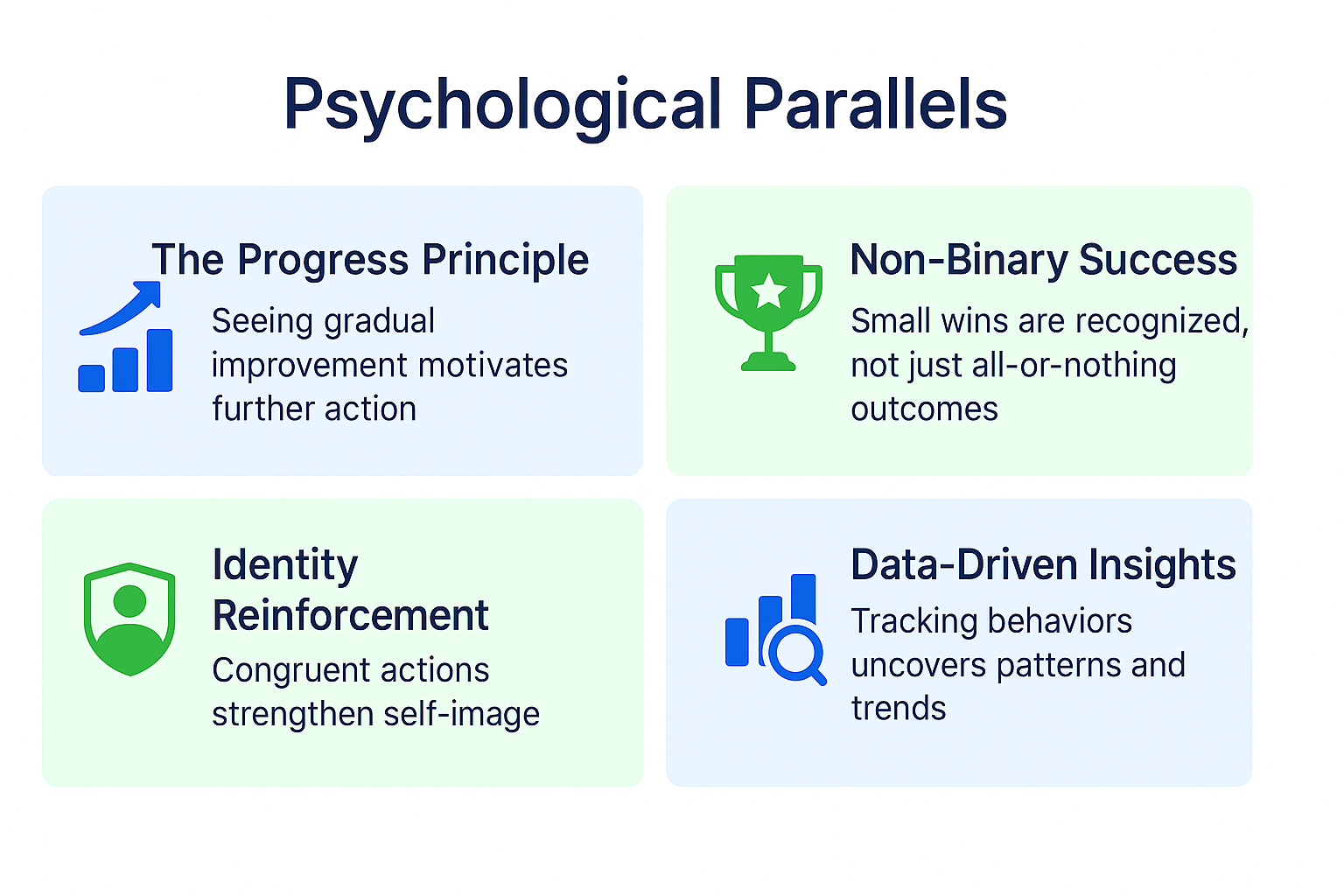

Psychological Parallels: The Hidden Similarities

Beyond these structural similarities, calorie tracking and financial tracking tap into the same psychological mechanisms:

1. The Progress Principle

Research by Harvard's Teresa Amabile shows that seeing small daily progress is incredibly motivating. Both calorie tracking and financial tracking provide this daily feedback loop, creating a sense of progress that fuels continued engagement.

2. Non-Binary Success

Both systems reframe success as a spectrum rather than binary. Instead of "on the wagon/off the wagon" thinking, they create a continuum where every day presents new opportunities to align with your goals.

3. Identity Reinforcement

Each tracking action subtly reinforces a positive identity ("I'm someone who makes mindful food choices" or "I'm someone who makes mindful spending choices"). This identity-based approach creates more sustainable behavior change than rule-following.

4. Data-Driven Insights

Both approaches reveal patterns that might otherwise remain invisible. Calorie trackers often discover unexpected sources of calories; DASPR users frequently identify spending patterns they never noticed before.

What Real Users Say: The Identical Experience

The parallels between calorie tracking and DASPR aren't just theoretical—they're vividly reflected in user experiences. In fact, many DASPR users explicitly make this connection:

"I've used MyFitnessPal for years, and DASPR feels exactly the same, just for money instead of food. That moment of pause before spending feels identical to the pause before eating something indulgent."

— Alex, DASPR beta tester"I never stuck with a budget before, but DASPR works for me because it's like calorie counting—I still eat the foods I want, just more mindfully. Same with spending—I still buy things I want, just with more awareness."

— Jamie, early DASPR adopter"After using Lose It! for weight management, DASPR made perfect sense to me. Both give me one clear number to guide my decisions, and both help me develop better habits without feeling deprived."

— Taylor, DASPR beta userIt's striking how consistently users make this connection without prompting. The familiar mental model of calorie tracking helps new users intuitively understand how DASPR works, reducing the learning curve and increasing adoption.

The Science of Habit Formation: Why Both Work

The ultimate reason both calorie tracking and financial tracking work so well is that they align perfectly with the science of habit formation.

According to behavior scientist B.J. Fogg's research, lasting habits form when three elements converge:

- Motivation - The desire to change

- Ability - The ease of performing the behavior

- Prompt - A trigger to perform the behavior

Both calorie tracking and DASPR optimize all three elements:

| Element | Calorie Tracking | DASPR |

|---|---|---|

| Motivation | Health goals, appearance, energy | Financial goals, reduced anxiety, security |

| Ability | Quick food logging, barcode scanning | Two-second transaction recording |

| Prompt | Meals and snacks as natural prompts | Purchases as natural prompts |

By aligning with these fundamental principles of behavior change, both approaches create sustainable habits that can last for years rather than the weeks that most diets and budgets survive.

Beyond Tracking: The Wellness Shift

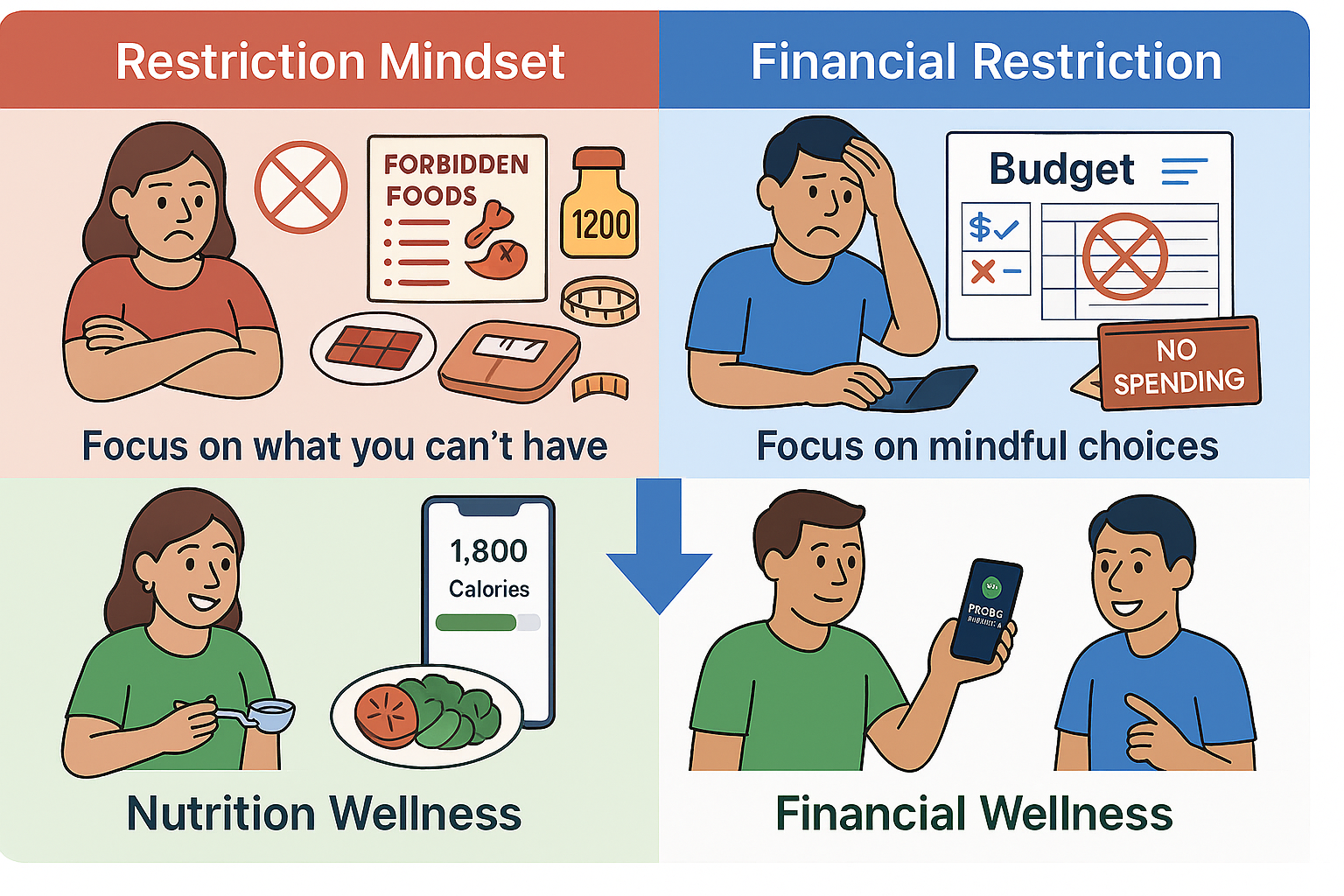

Perhaps the most important parallel is the philosophical shift both approaches represent: from restriction to wellness.

Traditional diets focus on what you can't eat. Traditional budgets focus on what you can't buy. Both create a sense of deprivation that's psychologically unsustainable.

In contrast, modern calorie tracking apps frame nutrition as wellness, not restriction. Similarly, DASPR frames finances as wellness, not deprivation.

This wellness approach acknowledges that:

- The goal is progress, not perfection

- Occasional indulgences fit within a healthy overall pattern

- Awareness, not restriction, is the primary mechanism of change

- Individual choices should align with personal values and goals

This shift from a deprivation mindset to a wellness mindset explains why both approaches succeed where traditional diets and budgets fail. They work with human psychology rather than against it.

Both domains have shifted from restriction to wellness-focused approaches

Getting Started: The Calorie Tracking Advantage

If you've used a calorie tracking app before, you have a significant advantage when starting with DASPR. You already understand the core mental model and have developed the habit of mindful tracking.

Here's how to leverage your calorie tracking experience with DASPR:

1. Apply the Same Routine

If you check your remaining calories at specific times (morning, before meals, evening), check your Daily Safe Spend at those same times. Piggyback on your existing habit loop.

2. Use the Same Mental Framing

Think of your Daily Safe Spend like your daily calorie target—not a strict limit but a guidepost for making mindful decisions.

3. Look for Patterns, Not Perfection

Just as one high-calorie day doesn't ruin your nutrition, one high-spending day doesn't ruin your finances. Focus on patterns over time.

4. Transfer the Awareness Skill

The awareness muscle you've developed with food choices transfers directly to spending choices. It's the same skill applied to a different domain.

5. Embrace the Flexibility

Use DASPR's Flex Buffer like you might use weekly averages in calorie tracking—as a way to accommodate occasional indulgences while maintaining overall balance.

Same Routine

Check at the same times

Same Framing

Guidepost, not limit

Pattern Focus

Trends, not perfection

Awareness Transfer

Same skill, new domain

Flex Approach

Balance over time

Conclusion: Financial Fitness Through Awareness

The remarkable parallels between calorie tracking and financial tracking aren't coincidental. They reflect fundamental truths about human behavior and effective habit formation.

Just as millions have transformed their physical health through the simple act of calorie awareness, you can transform your financial health through spending awareness. The psychological mechanisms are identical.

DASPR brings the proven approach of calorie tracking to your finances—simplifying complexity into one clear number, creating powerful moments of awareness, and building sustainable habits through consistency rather than perfection.

Whether you're a veteran calorie tracker or new to both domains, the principles remain the same: awareness creates change. Simple tracking creates awareness. And small daily choices, made mindfully, create profound transformation over time.

Ready to bring the power of tracking to your finances? Download DASPR and discover how a fitness app for your money can transform your financial health one decision at a time.

"Financial wellness, like physical wellness, isn't created through dramatic interventions but through mindful daily habits maintained over time."

Share this article: