Like compound interest, small financial decisions accumulate to create dramatic results over time

The $5 coffee. The $15 lunch. The $12 rideshare. In isolation, these everyday expenses seem insignificant—small choices that couldn't possibly impact your financial future in a meaningful way.

But what if these seemingly minor decisions are actually the most important financial choices you make?

While we tend to focus on big financial decisions—buying a home, choosing investments, negotiating salary—research increasingly shows that it's the small, daily choices that often have the most profound impact on our financial health.

In this article, we'll explore the science of how small decisions compound over time, examine real-world examples of their impact, and provide practical strategies for harnessing the power of daily choices to transform your financial future.

The Surprising Math of Daily Decisions

To understand the power of daily financial choices, we need to look at the math behind them—specifically, the concept of compounding.

We're familiar with compound interest in investing: money grows not just on the principal but also on the accumulated interest, creating an exponential growth curve. But the same mathematical principle applies to daily spending decisions, just in reverse.

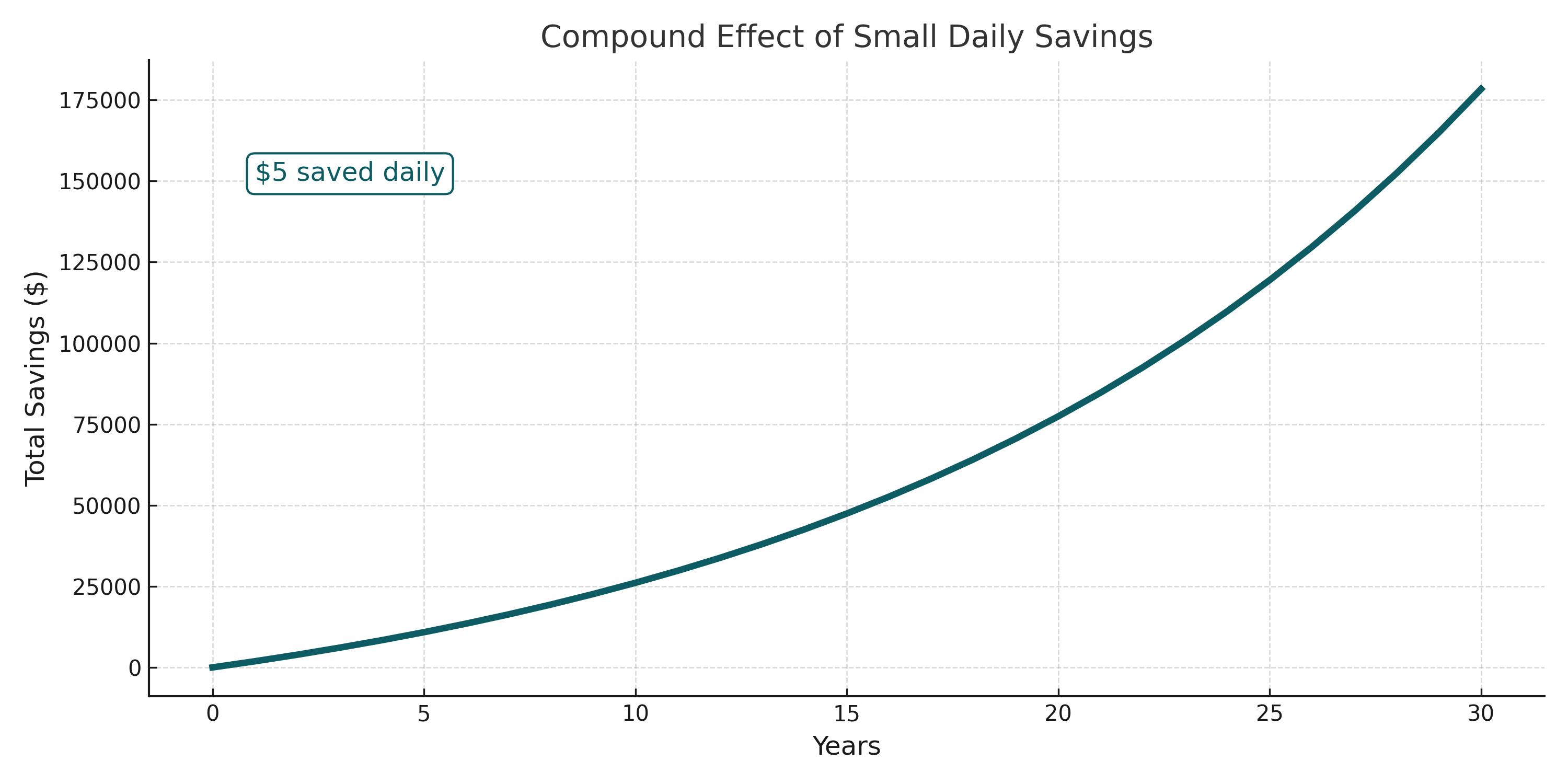

Let's take a simple example: a $5 daily coffee purchase.

$5 per day × 365 days = $1,825 per year

That's significant on its own, but the true impact comes when we consider the opportunity cost—what that money could have become if invested instead:

$1,825 per year invested at 7% annual return for 10 years = $25,898

That daily $5 decision compounds to nearly $26,000 over a decade. Extend that to 30 years, and the figure becomes staggering:

$1,825 per year invested at 7% annual return for 30 years = $170,114

This isn't to suggest you should never buy coffee—it's simply to illustrate how small, repeated choices create outsized results over time.

The compound effect of a $5 daily decision over 30 years

Beyond Coffee: The Real Daily Decisions That Matter

While the "$5 coffee" has become the poster child for daily financial decisions, our days are filled with dozens of small choices that have similar compounding effects:

- Lunch choices - Bringing lunch from home vs. buying ($10-15 daily difference)

- Transportation decisions - Public transit vs. rideshare ($10-20 daily difference)

- Subscription services - The cumulative effect of multiple $10-15 monthly subscriptions

- Impulse purchases - Small unplanned buys that add up to significant amounts

- Energy usage - Daily habits that affect utility bills

These decisions aren't just about saving money—they're about making conscious choices aligned with your priorities. The key insight is awareness: when you recognize the long-term impact of daily decisions, you make them more mindfully.

The Science of Small Decisions

Research in behavioral economics and habit formation provides fascinating insights into why small daily decisions are so powerful:

1. Keystone Habits and Ripple Effects

Psychologist Charles Duhigg's research on "keystone habits" shows that some small habits create a cascade of other positive changes. Financial keystone habits—like daily spending awareness—often trigger improvements in other areas.

In a 2022 study, participants who maintained daily financial awareness reported not only improved spending habits but also better sleep, reduced anxiety, and even healthier eating habits—a remarkable ripple effect from one small daily practice.

2. Identity-Based Habits

James Clear's work on habit formation highlights the power of identity-based habits. When small daily financial decisions align with your self-image ("I'm someone who makes mindful spending choices"), they become self-reinforcing and sustainable.

This explains why tracking daily spending works better than setting monthly budgets—it reinforces your identity as a financially mindful person with each small decision.

3. The Progress Principle

Harvard researchers Teresa Amabile and Steven Kramer discovered the "progress principle"—the finding that making consistent small progress is more motivating than occasional big wins.

In financial terms, the daily satisfaction of making good spending choices provides more consistent motivation than large but infrequent financial milestones.

How behavioral science explains the power of small financial decisions

Real People, Real Results

The power of small daily decisions isn't just theoretical. Here are three real-world examples from DASPR users who transformed their financial lives through daily awareness:

Mark: The Lunch Switch

Mark, a 36-year-old graphic designer, made just one change: bringing lunch from home four days a week instead of buying it. The savings—about $50 weekly—seemed modest, but he directed those funds to his student loan principal. The result? He paid off his loans 3.5 years ahead of schedule, saving $14,782 in interest.

"I was stunned by the impact of one small change. And honestly, I don't even miss buying lunch every day."

Leila: The Subscription Audit

Leila, a 29-year-old teacher, realized she was spending $116 monthly on subscriptions, many of which she rarely used. After auditing and cutting back to her essential services, she reduced this to $43 monthly. The $73 monthly difference, invested in her retirement account, is projected to add over $127,000 to her retirement savings over her career.

"I thought budgeting was about big sacrifices, but it was these small monthly charges that were really impacting my future."

Carlos: The "Pause Day"

Carlos, a 42-year-old consultant, implemented a simple rule: a 24-hour "pause" before any non-essential purchase over $30. This small habit ended up reducing his discretionary spending by 31%, freeing up $7,200 annually that he now splits between vacation savings and investments.

"The pause doesn't mean I never buy things—it just means I make conscious decisions rather than impulse purchases. Most of the time, I realize I don't actually want the item that badly."

Each of these examples involves a small daily or recurring decision that, on its own, might seem inconsequential. But the compounded effect over time created significant financial transformation.

The Hidden Multiplier: Awareness

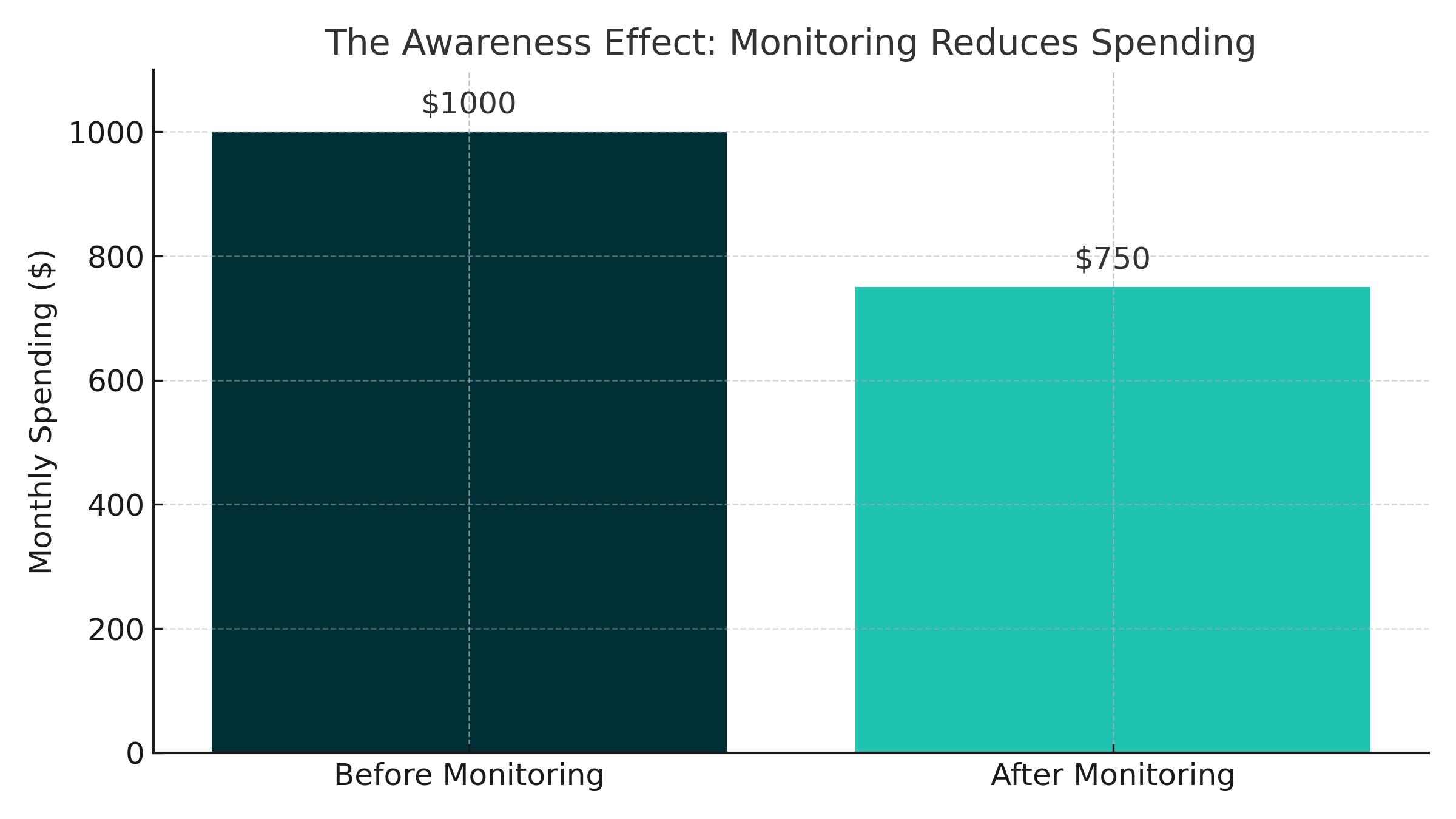

What's fascinating about small financial decisions is that simply being aware of them often changes them—a phenomenon researchers call the "monitoring effect."

Studies show that people who track their daily spending typically reduce it by 15-20%, even without setting explicit goals to spend less. This awareness creates a subtle but powerful feedback loop: each time you record a purchase, you create a moment of evaluation that gradually shifts behavior.

This is why DASPR focuses on daily awareness rather than complex budgeting rules. The act of checking your Daily Safe Spend and recording transactions creates the conditions for natural behavior change without requiring willpower or restriction.

"Small decisions made consciously create more financial impact than elaborate plans made rarely."

The awareness effect: How monitoring daily spending naturally reduces it

Implementing Small Changes: The 3% Shift Strategy

If you're inspired to harness the power of small daily decisions, a practical approach is what we call the "3% Shift Strategy." The concept is simple: look for tiny adjustments (around 3%) in your daily financial choices that won't significantly impact your quality of life but will compound dramatically over time.

Here's how to implement it:

1. Identify Your Daily Financial Touchpoints

Track all your spending for a week to identify your recurring daily or weekly expenditures. These are your financial touchpoints—the decisions you make regularly that can be optimized.

2. Apply the "Will I Notice?" Test

For each touchpoint, ask: "If I reduced this by 3%, would I actually notice?" For example:

- Downgrading from premium to regular coffee (savings: ~$0.50)

- Walking the last half-mile instead of extending a rideshare (savings: ~$3)

- Choosing a slightly less expensive lunch option (savings: ~$1-2)

3. Implement Consistently, Not Severely

The key to the 3% Shift is consistency rather than severity. A small change you'll maintain for years is infinitely more powerful than a dramatic but unsustainable budget cut.

4. Direct the Savings Purposefully

The magic happens when you direct these small savings toward a specific financial goal—debt reduction, investment, or savings. Set up automatic transfers that capture these micro-savings before they disappear into general spending.

The 3% Shift Strategy works because it's psychologically sustainable. You're not sacrificing quality of life, but you're creating significant long-term impact through the power of compounding.

Common Mistakes with Small Decisions

While focusing on daily financial decisions is powerful, there are common pitfalls to avoid:

The Substitution Trap

Sometimes we save in one category only to spend more in another. For example, bringing lunch from home but then treating yourself to an expensive coffee "because you saved money." This substitution negates the compounding benefit.

The Deprivation Mindset

Viewing daily decisions through a lens of deprivation ("I can never have coffee shop coffee") rather than empowerment ("I choose when coffee is worth it to me") leads to unsustainable habits and eventual abandonment.

The Big Win Distraction

Focusing exclusively on major financial decisions (like refinancing a mortgage) while ignoring daily habits. Both matter, but daily decisions often have greater cumulative impact because of their frequency and compounding effect.

The All-or-Nothing Approach

Attempting to optimize every single daily decision leads to decision fatigue and burnout. It's more effective to focus on your highest-impact recurring expenditures than to agonize over every penny.

Common pitfalls when focusing on daily financial decisions

Creating Your Daily Decision Framework

To harness the power of daily financial decisions, you need a simple framework that creates awareness without overwhelming you. Here's a practical approach:

1. Know Your Daily Number

Calculate how much you can sustainably spend each day on discretionary expenses. This "Daily Safe Spend" becomes your North Star for daily decisions. It should account for your income, fixed expenses, and savings goals, divided by days in the month.

2. Create Morning Awareness

Check your Daily Safe Spend each morning as part of your routine. This primes your brain to make mindful decisions throughout the day. Research shows that morning financial check-ins are significantly more effective than evening reviews.

3. Record in the Moment

Log transactions as they happen rather than batching them later. This creates the crucial moment of awareness when it can actually influence behavior. A simple app like DASPR makes this a two-second process.

4. Focus on Patterns, Not Perfection

Look for trends in your daily decisions rather than obsessing over individual purchases. The goal is to gradually shift your patterns, not to make perfect choices every time.

5. Connect Daily to Long-Term

Regularly visualize how your daily choices connect to your long-term goals. This creates the emotional motivation to maintain awareness of small decisions.

Know Your Number

Establish your Daily Safe Spend

Morning Check-in

Start each day with awareness

Record Immediately

Track spending as it happens

Monitor Patterns

Look for trends, not perfection

Connect to Goals

Visualize the long-term impact

The Compound Effect in Action: A 5-Year Visualization

To appreciate the true power of small daily decisions, let's visualize their compound effect over five years with a realistic example:

Imagine you implement three small daily changes:

- Bringing lunch from home 3 days/week (savings: $30/week)

- Reducing rideshare use by walking more (savings: $15/week)

- Cutting one underused subscription (savings: $10/month)

These changes amount to approximately $192/month—not life-changing on their own. But let's see what happens when you direct these savings to paying down a 17% APR credit card debt of $8,000:

Interest saved: $684

Debt reduced: $2,988

Interest saved: $1,502

Debt reduced: $6,794

Interest saved: $2,115

Debt reduced: $10,311

Debt fully paid!

Investment growth: $4,961

Financial freedom days: +24

By making three small daily changes that most people wouldn't notice in their lifestyle, you've paid off high-interest debt 7 years early (saving $4,301 in interest) and built a growing investment that will continue to compound.

This illustrates the remarkable power of small daily decisions—not because any individual choice is significant, but because their consistency and compounding effect create dramatic long-term results.

Conclusion: Small Hinges Swing Big Doors

In the world of personal finance, we're often drawn to dramatic changes and big moves—negotiating salary increases, refinancing mortgages, or finding the perfect investment. These matter, but the research is clear: it's the small daily decisions, consistently made with awareness, that often create the most profound financial transformation.

As Darren Hardy writes in "The Compound Effect," small, smart choices + consistency + time = radical difference. This principle applies in fitness, education, relationships, and especially personal finance.

The most powerful financial tool you have isn't a complex investment strategy or budget spreadsheet—it's your daily awareness of spending decisions and their long-term impact. This awareness, maintained consistently, creates the conditions for sustainable financial progress without requiring deprivation or superhuman willpower.

Ready to harness the power of small daily choices? Learn how DASPR makes daily financial awareness simple by giving you one clear number: what you can safely spend today.

"The way you spend your days is the way you spend your life. And the way you spend your dollars today shapes your financial future tomorrow."

Share this article: