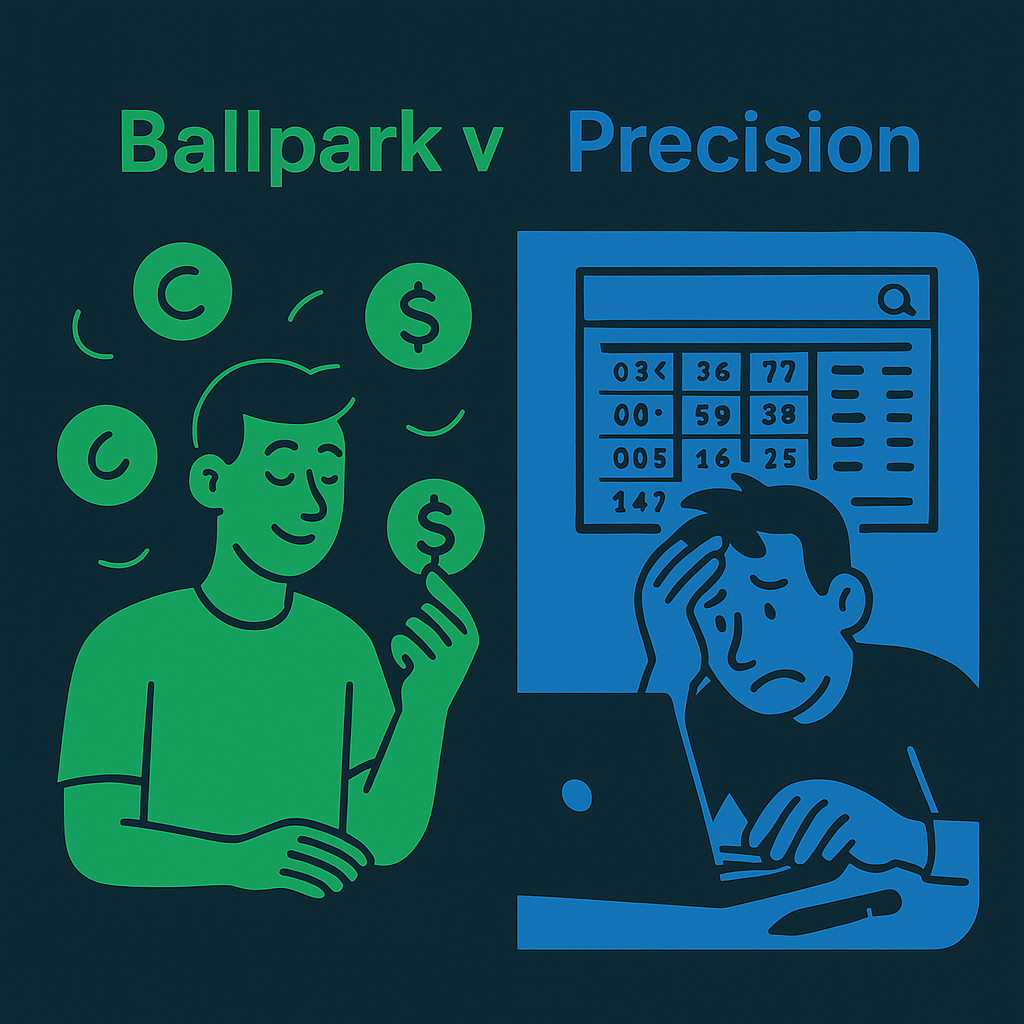

Ballpark vs. Precision: Why "Good Enough" Works Better

DASPR embraces approximate accuracy because we understand that behavior change, not accounting precision, is what creates financial wellness.

Traditional Apps Demand:

- Exact figures for every transaction

- Perfect categorization

- Receipt scanning and matching

- Analysis paralysis

DASPR Understands:

- $7 is close enough for $6.71

- The act of recording matters most

- Reduced friction = sustainable habits

- Progress over perfection

Research shows that people who track spending with 80% accuracy achieve the same behavioral changes as those who track with 100% accuracy—but they're more likely to maintain the habit long-term.