The obsession with financial precision often leads to frustration and abandonment

You're standing in line at the coffee shop. Your americano costs $4.35. Do you record $4.35 in your finance app? $4.50? Round to $4? Or maybe just $5 to be safe?

This seemingly trivial decision reflects a deeper question about personal finance management: How much precision do we actually need?

The conventional wisdom suggests more precision is always better. Track every penny. Categorize meticulously. Reconcile to the cent. But what if this obsession with financial precision is actually preventing you from achieving better financial habits?

At DASPR, we've built our approach around a counterintuitive truth: ballpark amounts often lead to better financial outcomes than perfect precision. Here's why "good enough" tracking works better than exactitude for most people.

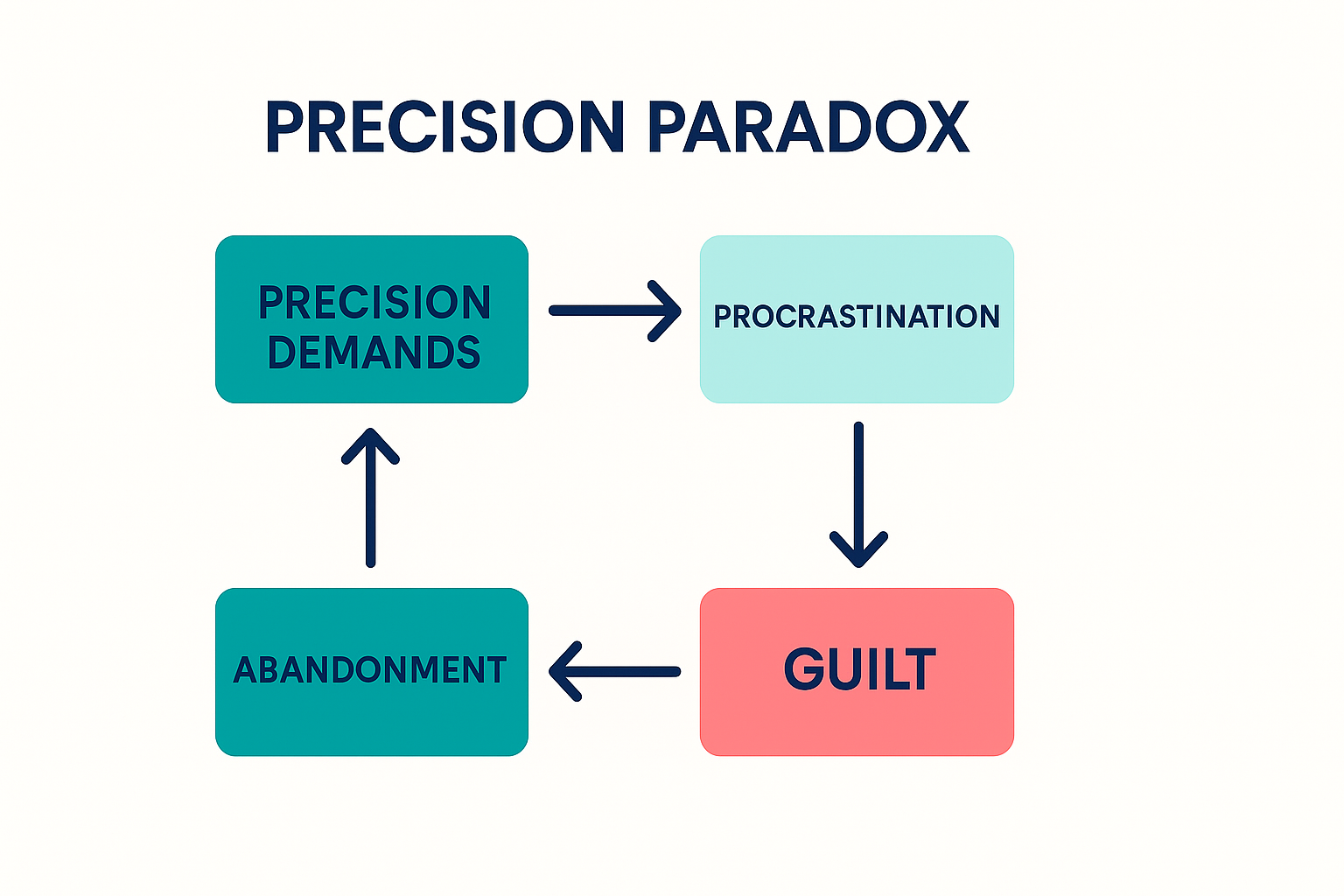

The Precision Paradox

In theory, tracking your finances with perfect precision should lead to optimal financial decisions. You should know exactly what you spend, where it goes, and how to optimize every dollar.

In practice, however, something very different happens:

- People become overwhelmed by the effort required to maintain precision

- They feel guilty when they inevitably miss transactions or make errors

- They procrastinate on data entry, creating backlogs that become increasingly daunting

- Eventually, many abandon financial tracking altogether

This is what we call the Precision Paradox: the pursuit of perfect financial data often leads to no financial data at all.

"Perfect is the enemy of good. And in personal finance, it's often the enemy of getting started at all."

The Precision Paradox: How the pursuit of perfect tracking leads to abandonment

What Financial Research Actually Shows

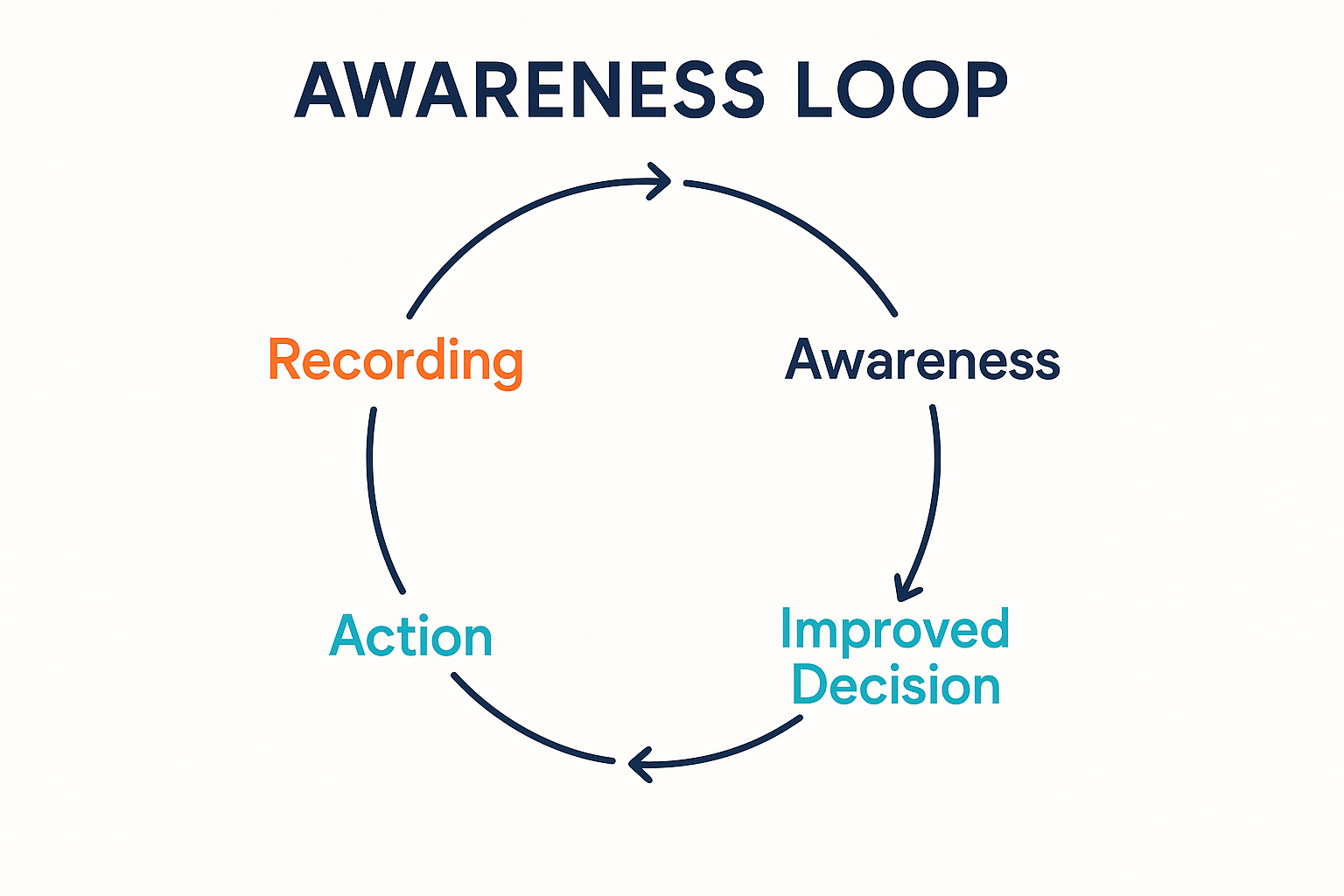

The evidence from behavioral finance research is clear: consistency matters far more than precision. Studies of successful personal finance management consistently show:

- Habit formation is key - Regular financial check-ins predict success better than detailed tracking

- Awareness drives behavior change - The act of recording creates more behavior change than the accuracy of what's recorded

- Sustainability trumps perfection - Systems that people actually maintain outperform theoretically superior systems that people abandon

A 2023 study by researchers at the Financial Behavior Research Institute followed 2,500 individuals for 18 months. They found that people who maintained consistent "ballpark" tracking had significantly better financial outcomes than those who attempted perfect tracking but did so inconsistently.

The study's author concluded: "Financial awareness, even if imprecise, creates the conditions for better decision-making. Consistency of practice matters more than decimal-point precision."

When Precision Gets in the Way

The pursuit of financial precision can actively hinder your progress in several ways:

1. Decision Fatigue

Tracking with perfect precision requires dozens of small decisions: Which category should this purchase go in? Should I split this grocery bill between "food" and "household items"? Every decision depletes your mental energy, leading to decision fatigue.

Research shows that we have a finite amount of decision-making capacity each day. When you exhaust it on financial minutiae, you have less for important financial decisions.

2. The Postponement Problem

When tracking demands precision, we tend to postpone it until we have "enough time to do it right." This leads to batching—saving up receipts to enter later—which eliminates the critical moment of awareness when the spending occurs.

This delayed tracking loses the immediate feedback that creates behavior change. By the time you record that coffee purchase three days later, the connection between the action and the recording is lost.

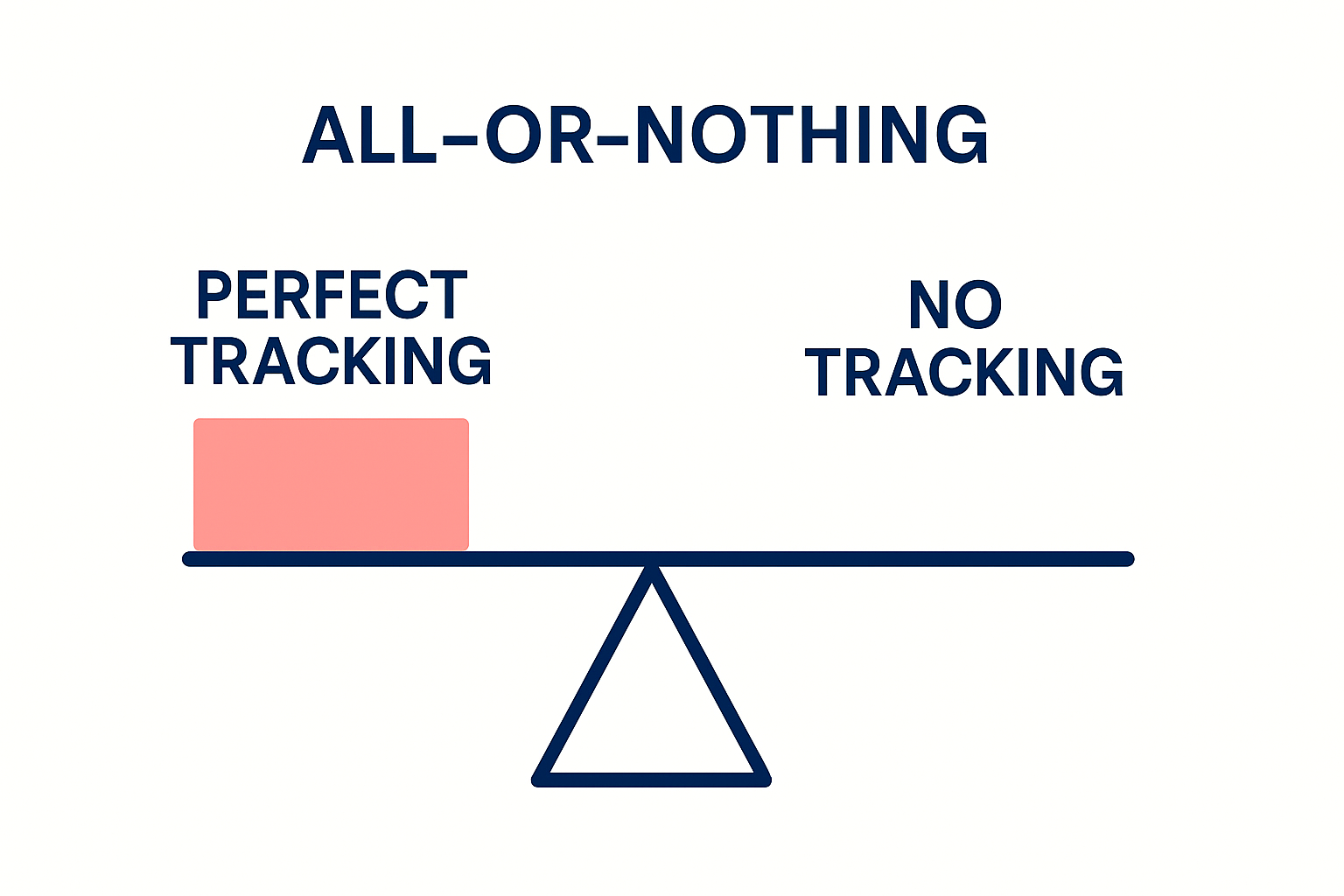

3. The Perfectionist Trap

Many people have an "all or nothing" mindset with financial tracking. If they can't do it perfectly, they don't do it at all. Missing a few transactions becomes reason to abandon the entire system.

This perfectionist trap prevents the consistency that actually builds financial awareness. It's better to track imperfectly for a year than perfectly for a week.

The perfectionist trap leads to the all-or-nothing mindset that undermines financial tracking

The Ballpark Advantage

So what's the alternative? A ballpark approach that prioritizes consistency, awareness, and sustainability over perfect precision. Here's how it works:

Round to Convenient Numbers

Instead of recording that $4.35 coffee as $4.35, simply record $4 or $5. For lunch, don't worry about $12.67—just put $13. This minor loss of precision is more than offset by the gains in ease and speed.

Simplify Categories

Rather than debating whether a purchase belongs in "dining," "entertainment," or "social," use broader categories—or better yet, focus on the total spending rather than category minutiae.

Focus on Trends, Not Data Points

Individual transactions matter less than patterns over time. A ballpark approach may miss a few dollars here and there, but it captures the trends that actually impact your financial health.

Prioritize In-the-Moment Recording

Record transactions immediately after they happen, even if the amount is approximate. This timing creates the crucial awareness moment that changes behavior, which is more valuable than precise data recorded days later.

Real-World Results: Jim's Story

Jim, a 29-year-old software developer, tried several detailed budgeting apps before discovering DASPR. His experience illustrates the power of the ballpark approach:

"With my previous app, I'd avoid recording transactions because it asked for exact amounts, receipts, and detailed categories. I'd let them pile up, then spend an hour on Sunday trying to remember what everything was. It was so tedious that I'd often give up for weeks at a time."

"With DASPR, I just round everything to the nearest dollar and tap 'add.' It takes two seconds, so I do it right away. The funny thing is, by being less precise but more consistent, I have a much clearer picture of my spending now than I ever did before."

Jim's experience matches what our user data shows: DASPR users record 94% of their discretionary transactions, compared to an industry average of less than 60% for traditional finance apps. This higher consistency creates better awareness and, ultimately, better financial habits.

Transaction recording consistency among different approaches to financial tracking

When Precision Actually Matters

Is precision ever important in personal finance? Absolutely. The key is understanding where precision adds value and where it creates unnecessary friction.

Precision Matters For:

- Tax-related expenses - Keep detailed records for tax deductions

- Business expenses - When you need to report to others or claim reimbursements

- Contractual obligations - Like debt payments where exact amounts are legally required

- Financial planning - When making specific calculations for major life events

Ballpark Works Better For:

- Daily discretionary spending - Coffee, meals, entertainment, etc.

- Regular habit tracking - Monitoring spending patterns over time

- Behavior change - Creating awareness of spending decisions

- Sustainable financial practices - Systems you'll actually maintain

The most effective approach combines precision where it matters with ballpark estimates where consistency is more important than exactitude.

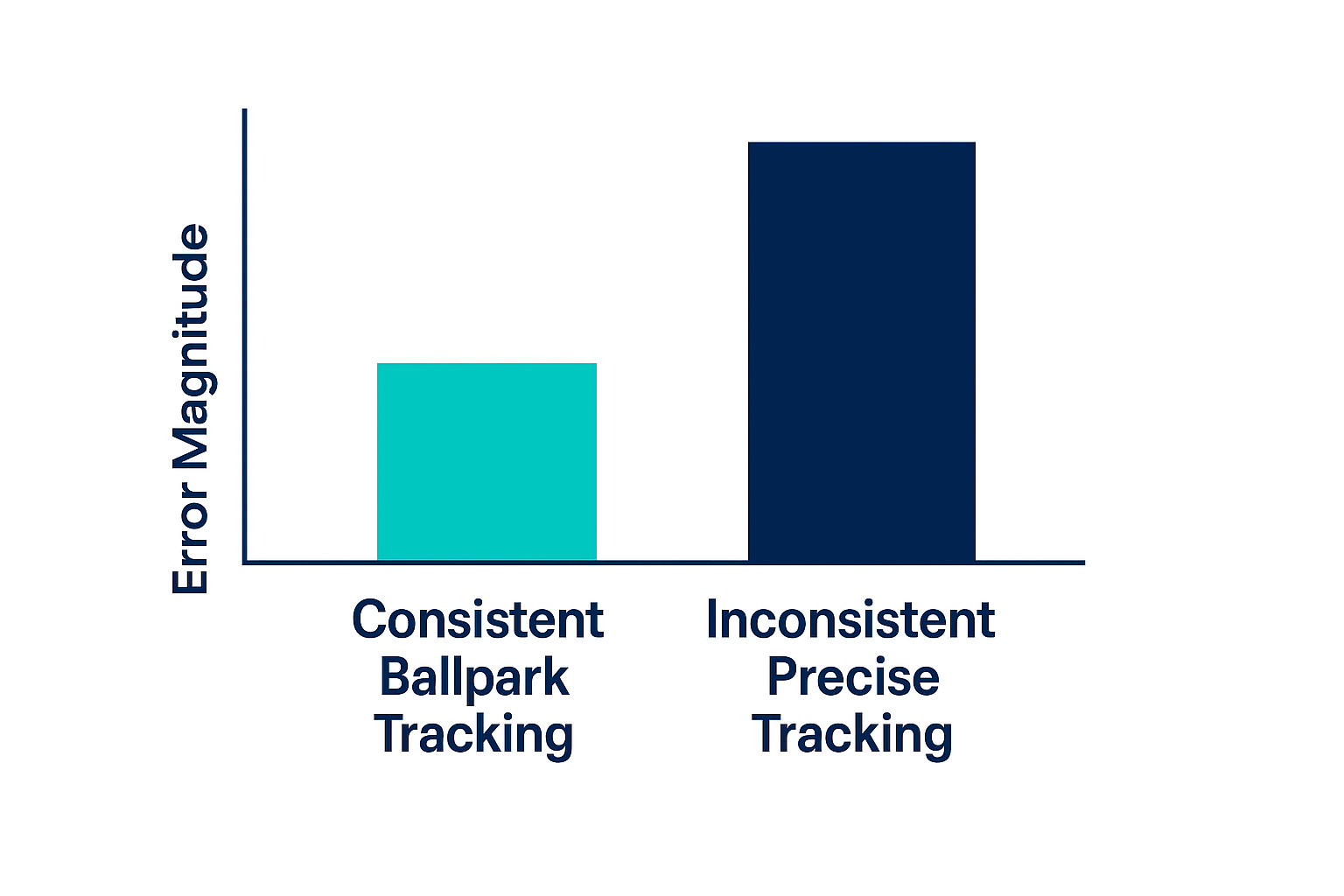

The Math Behind the Method

For those concerned about mathematical accuracy, consider this: if you round every transaction up to the nearest dollar, you introduce a maximum error of 99 cents per transaction. If you track 20 transactions per week, your worst-case error is about $20 per week, or $80 per month.

This might sound significant, but compare it to the error introduced by not tracking at all (which happens when precision becomes too burdensome). The average American makes approximately 70 discretionary purchases per month. If the average transaction is $15, not tracking creates an "error" of $1,050 per month.

Even if you only miss tracking 25% of transactions due to precision fatigue, that's still a $262.50 error—far larger than the worst-case $80 error from consistent rounding.

And in reality, rounding errors tend to partially cancel out (some round up, some round down), making the actual error from ballpark tracking even smaller.

Comparison of errors: Consistent ballpark tracking vs. inconsistent precise tracking

How to Embrace the Ballpark Approach

Ready to free yourself from the precision myth? Here's how to implement a more sustainable ballpark approach to financial tracking:

1. Set Clear Guidelines

Decide on your rounding rules in advance. Some people round to the nearest dollar, others to the nearest $5 for simplicity. Whatever you choose, make it consistent and easy to implement without thought.

2. Record Immediately

The ballpark approach works best when transactions are recorded right away. Make it a habit to take 2 seconds after a purchase to log the approximate amount.

3. Focus on the Awareness Moment

Remember that the primary value comes from the moment of awareness, not the data itself. Pay attention to how you feel when recording—this is where behavior change begins.

4. Look for Patterns, Not Pennies

When reviewing your spending, focus on identifying patterns and trends rather than analyzing specific transactions. The big picture matters more than the details.

5. Embrace Imperfection

If you miss a transaction, don't let it derail your entire system. The goal is progress, not perfection. Keep moving forward with the understanding that consistency trumps occasional lapses.

Set Clear Guidelines

Decide on simple rounding rules

Record Immediately

Log transactions right after they happen

Focus on Awareness

Pay attention to the moment of recording

Look for Patterns

Focus on trends, not individual amounts

Embrace Imperfection

Keep going even if you miss a transaction

Conclusion: Liberate Your Financial Tracking

The pursuit of perfect financial precision is a well-intentioned goal that often backfires. By embracing a ballpark approach, you can create a sustainable system that generates the awareness needed for better financial habits without the burden of exactitude.

Remember: the most accurate tracking system is the one you'll actually use consistently. If precision is causing you to track less often or giving up entirely, it's time to try the ballpark approach.

As we like to say at DASPR: You don't need to track every penny to change your relationship with every dollar.

Ready to experience the freedom of ballpark financial tracking? Learn how DASPR makes it simple to build awareness without getting bogged down in details.

Share this article: