Behavioral economics reveals why traditional approaches to personal finance often fail

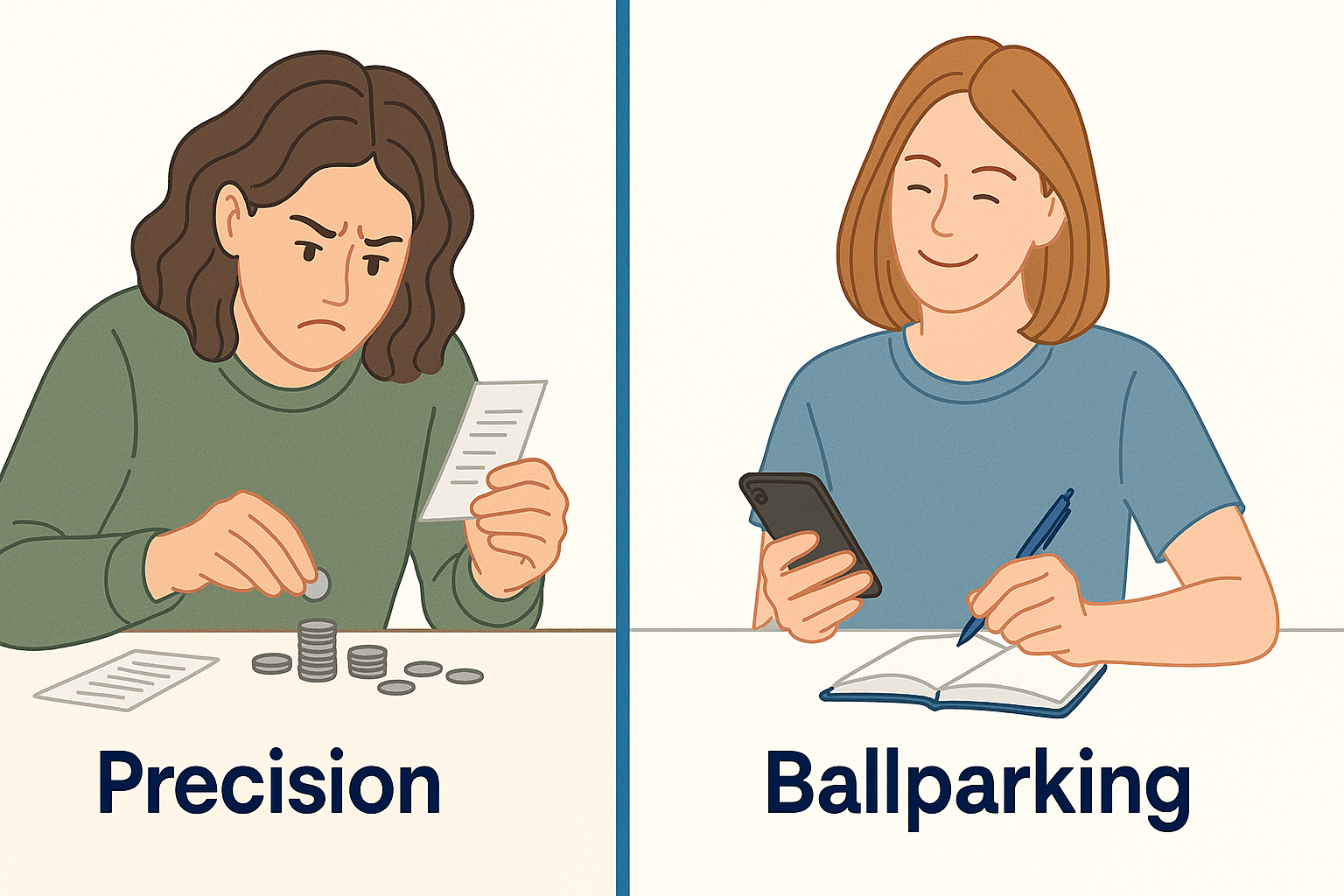

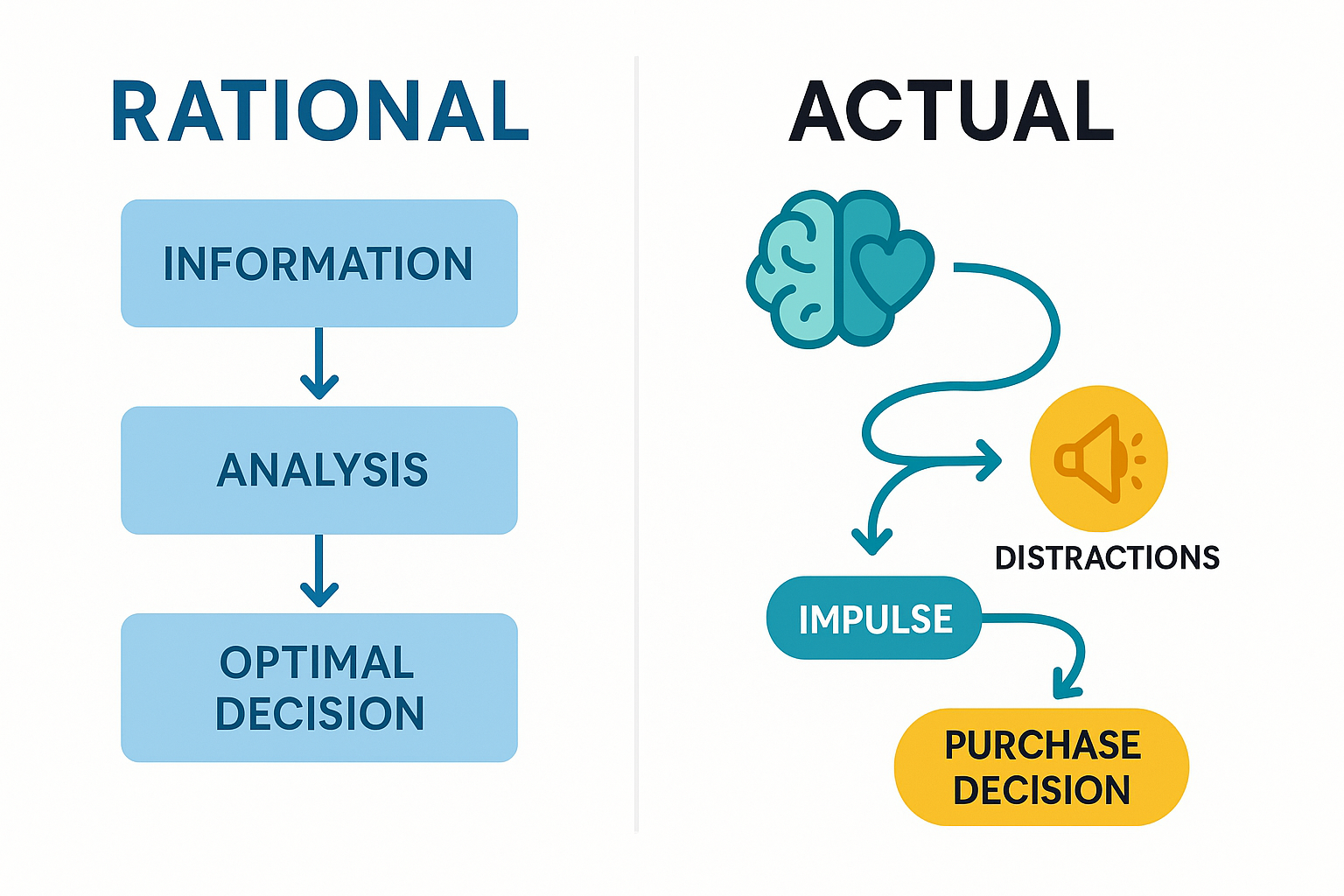

For decades, the standard approach to personal finance has been built on a faulty assumption: that humans make rational financial decisions based on perfect information. But a wealth of research in behavioral economics and financial psychology reveals a more complex truth—our financial behaviors are shaped by cognitive biases, emotional factors, and environmental cues that often bypass our rational thinking.

At DASPR, our approach is built on this research. We've designed an experience that works with human psychology rather than against it, focusing on awareness instead of automation. Here's the science that informs our philosophy.

The Limitations of Traditional Financial Theory

Traditional economic theory assumes people are rational actors who optimize their decisions based on complete information. This "homo economicus" model suggests we should:

- Carefully track every financial transaction

- Create detailed monthly budgets

- Follow those budgets with perfect discipline

- Regularly analyze spending across numerous categories

Yet study after study shows that even financially literate people struggle with these approaches. Why? Because they fail to account for how humans actually make decisions in the real world.

"Economic theory assumes humans are calculating machines. Behavioral economics shows we're social, emotional beings with limited attention and willpower."

— Dr. Richard Thaler, Nobel Prize Winner in Economics

The gap between theoretical and actual financial decision-making

Key Research Findings That Shape Financial Behavior

Let's examine the research findings that most significantly impact financial behavior—and how they inform a better approach to personal finance.

1. Present Bias: Why We Prioritize Now Over Later

One of the most robust findings in behavioral economics is present bias: our tendency to give stronger weight to payoffs that are closer to the present time.

The Research: In a landmark study by Laibson (1997), participants were asked to choose between receiving $15 now or $20 in a month. Most chose the immediate $15. However, when asked to choose between $15 in 12 months or $20 in 13 months, most chose the larger amount. The preferences were inconsistent, revealing our bias toward immediate rewards.

Real-World Impact: This explains why we struggle to save for the future—the immediate pleasure of spending today often outweighs the abstract benefit of financial security tomorrow.

Better Approach: Creating immediate awareness at the point of spending decision (rather than reviewing spending later) helps counteract present bias by making future consequences more salient in the present moment.

2. Mental Accounting: How We Categorize Money

Research by Nobel laureate Richard Thaler revealed that we don't treat all money as fungible (interchangeable). Instead, we mentally categorize it into different "accounts" and treat these accounts differently.

The Research: Thaler's studies showed people are more willing to spend money labeled as a "bonus" than identical amounts labeled as "savings." In one experiment, participants who received a small windfall labeled as "entertainment money" spent 25-50% more than those who received the same amount labeled as "grocery money."

Real-World Impact: This explains why traditional budgeting often fails—money is mentally fluid, moving between categories in ways that budgets don't account for.

Better Approach: A single daily spending number works better than complex category-based budgets because it aligns with how we naturally think about discretionary money—as one flexible pool.

How mental accounting affects financial decision-making

3. Choice Architecture: How Environment Shapes Decisions

Research by Thaler and Sunstein on "choice architecture" shows that the way options are presented dramatically influences our decisions.

The Research: A study of 401(k) enrollment found that changing from an opt-in to an opt-out system increased participation from 40% to 90%. The change in default option—a simple shift in choice architecture—had a massive impact on financial behavior.

Real-World Impact: The digital environments we navigate are designed to encourage spending, not saving. One-click purchasing, saved payment information, and frictionless transactions all create a choice architecture that promotes consumption.

Better Approach: Introducing strategic friction—like manual transaction recording—creates a choice architecture that supports more mindful spending. This "positive friction" is different from frustrating obstacles; it's a thoughtfully designed pause that allows for better decisions.

4. Implementation Intentions: The Power of If-Then Planning

Research by psychologist Peter Gollwitzer shows that concrete if-then plans dramatically increase follow-through on intentions.

The Research: In a meta-analysis of 94 studies involving over 8,000 participants, implementation intentions increased the likelihood of goal achievement by 50-80% compared to simply having good intentions.

Real-World Impact: Vague financial goals like "spend less" or "save more" rarely translate into action without specific implementation plans.

Better Approach: Daily financial awareness creates natural if-then planning: "If I have $X left to spend today, then I'll make these specific spending choices." This concrete frame converts general intentions into actionable decisions.

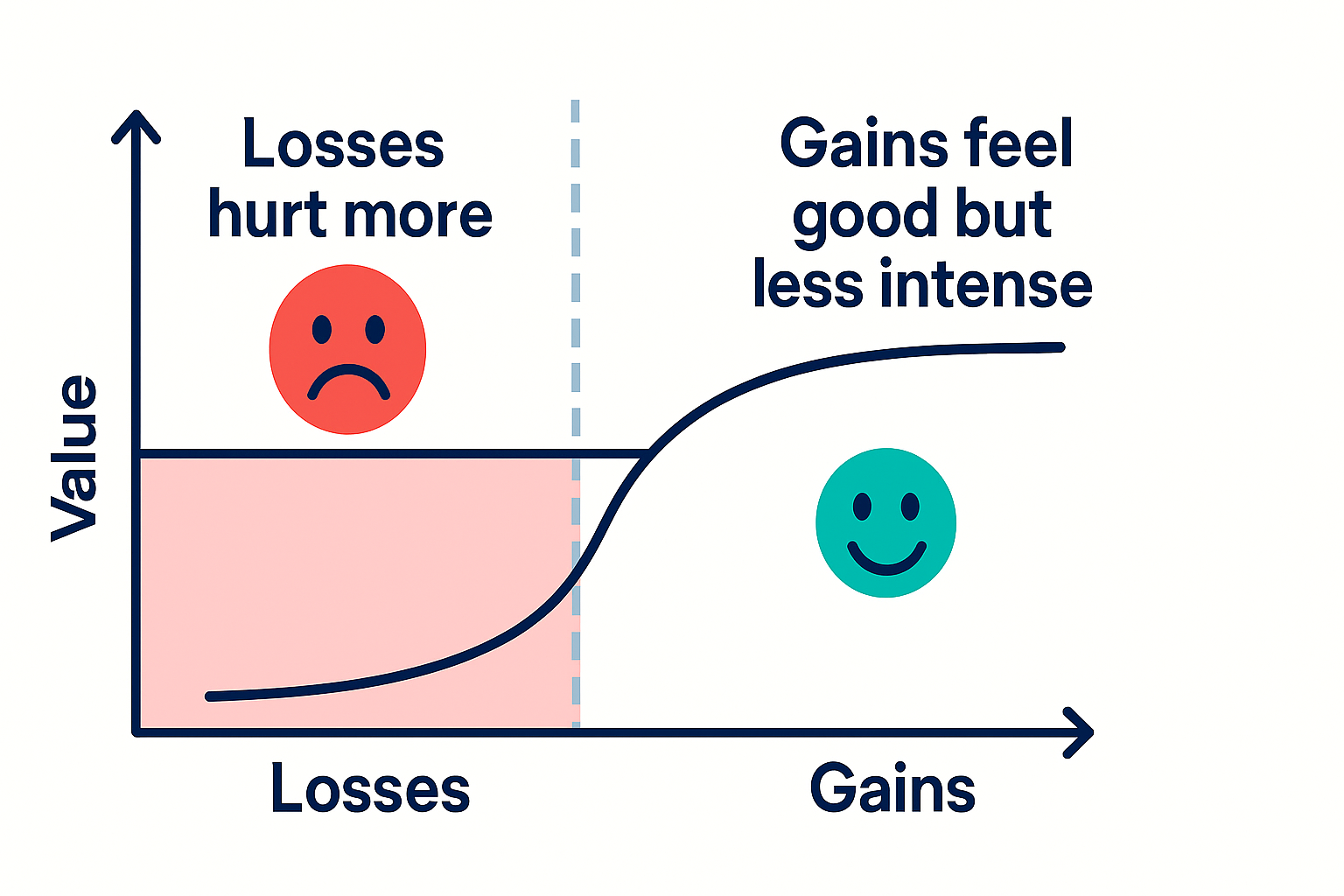

5. The Reflection Effect: Losses Loom Larger Than Gains

Kahneman and Tversky's prospect theory demonstrated that we feel losses more intensely than equivalent gains.

The Research: When offered a 50/50 chance to win $150 or lose $100, most people decline the bet, even though the expected value is positive ($25). The psychological impact of losing $100 outweighs the potential pleasure of gaining $150.

Real-World Impact: Traditional budgeting frames overspending as a "loss," triggering loss aversion and negative emotions that make people avoid engaging with their finances altogether.

Better Approach: Framing financial decisions in terms of daily wellness (like a "financial vital sign") shifts focus from loss avoidance to health maintenance, creating a more psychologically sustainable approach.

Kahneman and Tversky's Prospect Theory: How we perceive financial gains and losses

Awareness vs. Automation: What the Research Shows

One of the most significant debates in financial technology is whether awareness-based approaches or automation-based approaches lead to better outcomes. The research offers a nuanced answer.

The Case for Automation

Behavioral economist Shlomo Benartzi has shown that automatic savings programs dramatically increase savings rates. His Save More Tomorrow™ program, which automatically increases retirement contributions when employees receive raises, boosted savings rates from 3.5% to 13.6% over 40 months.

This research clearly demonstrates the power of automation for consistent behaviors we want to maintain—like regular savings.

The Case for Awareness

However, research on discretionary spending tells a different story:

- Self-monitoring studies by researchers like McFall and Hammen show that simply recording behavior changes the behavior itself, reducing impulsive spending by 15-20%.

- Mindfulness research by Brown and Ryan demonstrates that present-moment awareness substantially improves decision quality, especially for value-aligned choices.

- Feedback studies by Kluger and DeNisi reveal that immediate feedback on actions creates the fastest behavior change, particularly for habitual behaviors.

This research indicates that for behaviors we want to change—like discretionary spending habits—awareness-based approaches are more effective than automation.

The Integrated Approach

The optimal approach, according to the research, is an integrated one:

- Automate what should be consistent - Savings, bill payments, and fixed expenses

- Create awareness around what you want to change - Discretionary spending and daily choices

This balanced approach recognizes both the limitations of human cognitive capacity (which automation helps address) and the need for conscious engagement to create lasting behavior change (which awareness facilitates).

| Financial Behavior | Most Effective Approach | Research Support |

|---|---|---|

| Regular Savings | Automation | Benartzi & Thaler (2004) |

| Bill Payments | Automation | Madrian & Shea (2001) |

| Discretionary Spending | Awareness | McFall (2016) |

| Impulse Purchases | Awareness | Baumeister et al. (2008) |

| Habit Formation | Awareness | Wood & Neal (2016) |

The Neurological Basis of Financial Behavior Change

Recent neuroscience research provides additional insight into why awareness-based approaches work for changing spending habits.

Neuroplasticity and Habit Formation

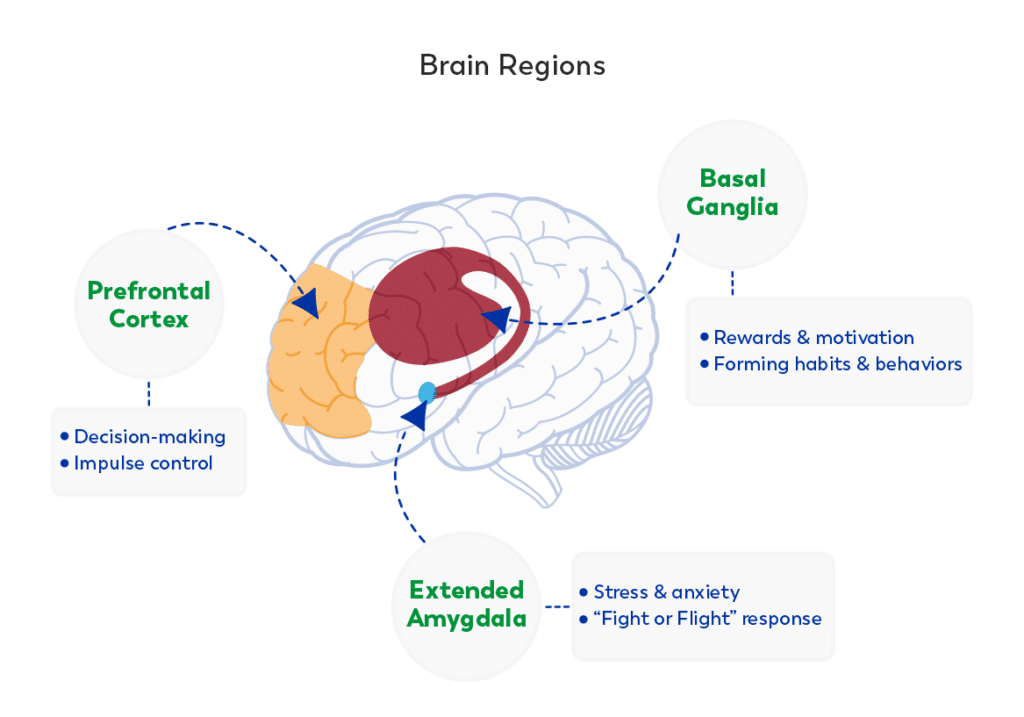

Neuroimaging studies by Yin and Knowlton (2006) show that habits are formed through the strengthening of neural pathways in the basal ganglia. Each time we repeat a behavior, we reinforce these pathways.

Crucially, the formation of new habits requires conscious attention during the learning phase. Automated tracking bypasses this attention, which explains why it fails to create lasting behavior change despite providing abundant data.

The Role of the Prefrontal Cortex

The prefrontal cortex—responsible for planning, decision-making, and moderating social behavior—must be engaged to override existing habits. Research by Lieberman (2007) shows that conscious labeling of actions activates the prefrontal cortex, creating the neural conditions necessary for behavior change.

Manual recording activates precisely this mechanism, engaging the brain regions necessary for forming new financial habits.

How different brain regions influence financial decision-making

DASPR's Research-Based Approach

Based on this substantial body of research, DASPR has developed a financial approach that works with human psychology rather than against it:

1. The Daily Focus

Research Basis: Studies on temporal discounting (Laibson, 1997) show that bringing future consequences into the present moment improves decision quality.

Implementation: DASPR's daily safe spend provides immediate feedback on how today's choices affect financial health, countering present bias.

2. Manual Transaction Recording

Research Basis: Self-monitoring research (McFall, 2016) demonstrates that recording behavior creates the awareness necessary for behavior change.

Implementation: DASPR's quick-add transaction feature creates a moment of awareness without becoming burdensome.

3. Single Number Focus

Research Basis: Decision fatigue studies (Vohs, 2008) show that simpler decision frameworks lead to better choices and more consistent follow-through.

Implementation: DASPR replaces complex category budgets with one clear number, reducing cognitive load while increasing compliance.

4. Flex Buffer System

Research Basis: Work on habit sustainability (Wood & Neal, 2016) shows that systems with built-in flexibility have higher long-term adoption rates.

Implementation: DASPR's Flex Buffer provides adaptability within structure, creating a system that can bend without breaking.

5. Visual Pulse Representation

Research Basis: Studies on visual feedback (Larrick & Soll, 2008) demonstrate that visual representations improve comprehension and emotional engagement compared to numbers alone.

Implementation: DASPR's Spend Pulse visualization creates an intuitive understanding of financial health that engages both analytical and emotional processing.

Conclusion: Evidence-Based Financial Wellness

The research is clear: lasting financial behavior change comes not from passive tracking or complex budgeting, but from creating moments of awareness that gradually reshape our financial habits.

By integrating findings from behavioral economics, psychology, and neuroscience, we can build financial tools that work with human nature rather than against it. This research-based approach doesn't demand superhuman discipline or perfect financial literacy—it simply creates the conditions where better financial habits can naturally emerge.

DASPR's "un-finance" approach isn't just a philosophy—it's grounded in decades of scientific research on how humans actually make financial decisions. By focusing on awareness rather than automation, we've created a system that not only tracks your finances but transforms your relationship with money.

Ready to experience research-based financial wellness? Learn how DASPR applies these scientific principles to create lasting financial behavior change.

Key Research References

- Thaler, R. H., & Benartzi, S. (2004). Save More Tomorrow™: Using behavioral economics to increase employee saving. Journal of Political Economy, 112(S1), S164-S187.

- Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291.

- Laibson, D. (1997). Golden Eggs and Hyperbolic Discounting. The Quarterly Journal of Economics, 112(2), 443-478.

- Thaler, R. (1985). Mental Accounting and Consumer Choice. Marketing Science, 4(3), 199-214.

- McFall, L. (2016). The Effect of Self-Monitoring on Discretionary Spending Behaviors. Journal of Consumer Psychology, 26(1), 25-36.

- Wood, W., & Neal, D. T. (2016). Healthy through habit: Interventions for initiating & maintaining health behavior change. Behavioral Science & Policy, 2(1), 71-83.

Share this article: